The trucking sector is one of the most important pillars of transportation in the supply chain. Thanks to Canada’s extensive road network, trucks are the primary mode of transport used to ship goods across the country. The trucking sector is also the key mechanism for trade with the United States – Canada’s number one trading partner. However, the lack of harmonized regulations, both among the provinces and between the countries, hinders the flow of trade. In addition, the sector faces many challenges in responding to the growing demand, and the driver shortage is currently a major cause for concern. Initiatives aimed at diversifying the trucking sector, for example, by supporting under‑represented groups and encouraging them to join the profession, could help fill vacancies. Without counting the effects of the COVID‑19 pandemic, at a time where climate change has generated global concerns, the trucking sector is also being asked to reduce its environmental footprint, which presumably will require shifting to more environmentally friendly heavy vehicles.

Freight transport is an essential link in the supply chain; it plays a vital role in Canada’s economy by creating both jobs and wealth, directly and indirectly. Road transportation is currently the most common mode of freight transport in Canada, both for internal trade and for trade with the United States – Canada’s main trading partner. This HillStudy addresses the economic impact of the trucking sector, the regulatory framework under which it operates, and its challenges and perspectives.

From a historical point of view, transportation has always been a major pillar of Canada’s economic and social development. Today, it continues to play a key role in the growth of communities and in strengthening the vitality of domestic and international trade.

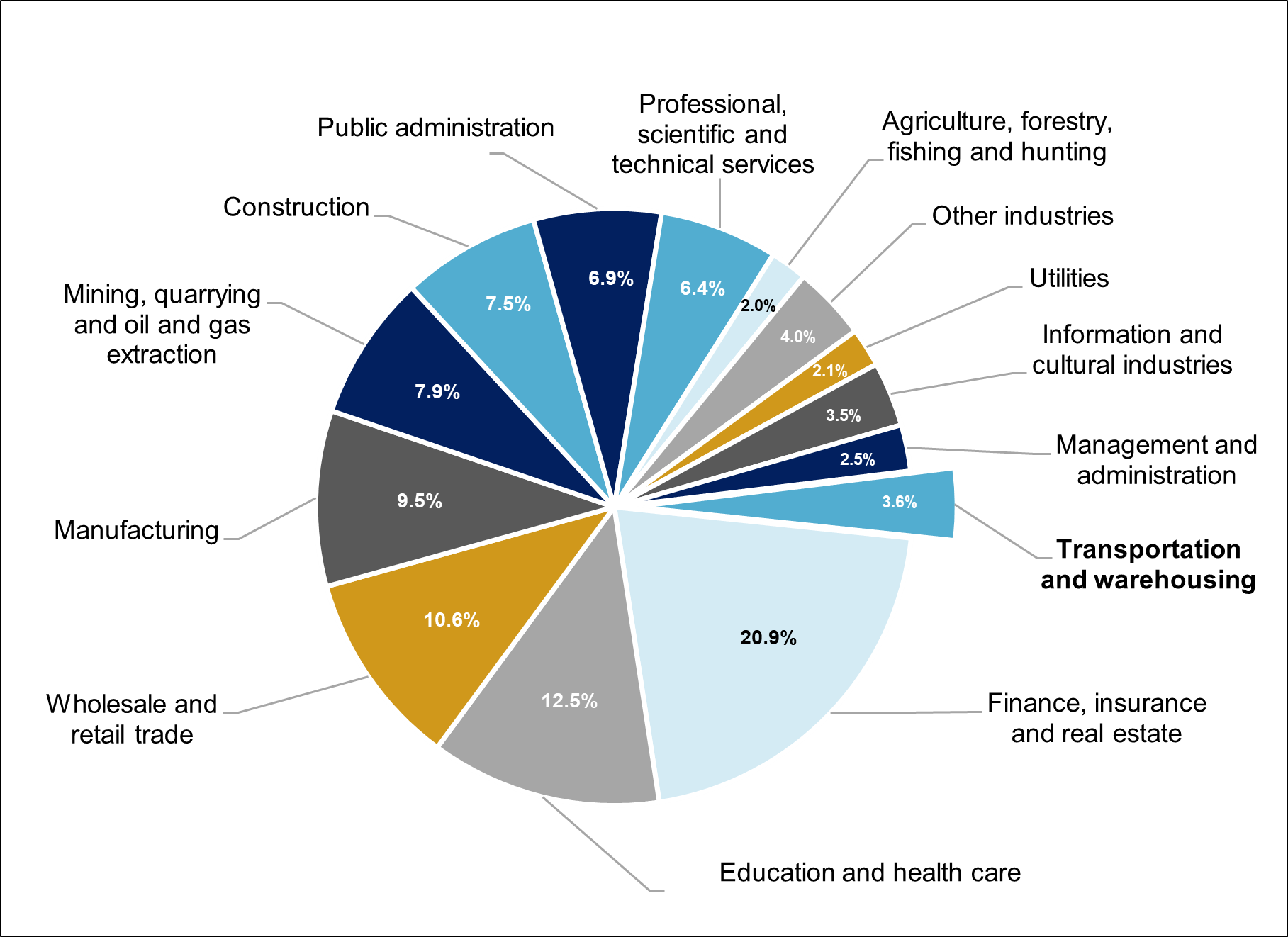

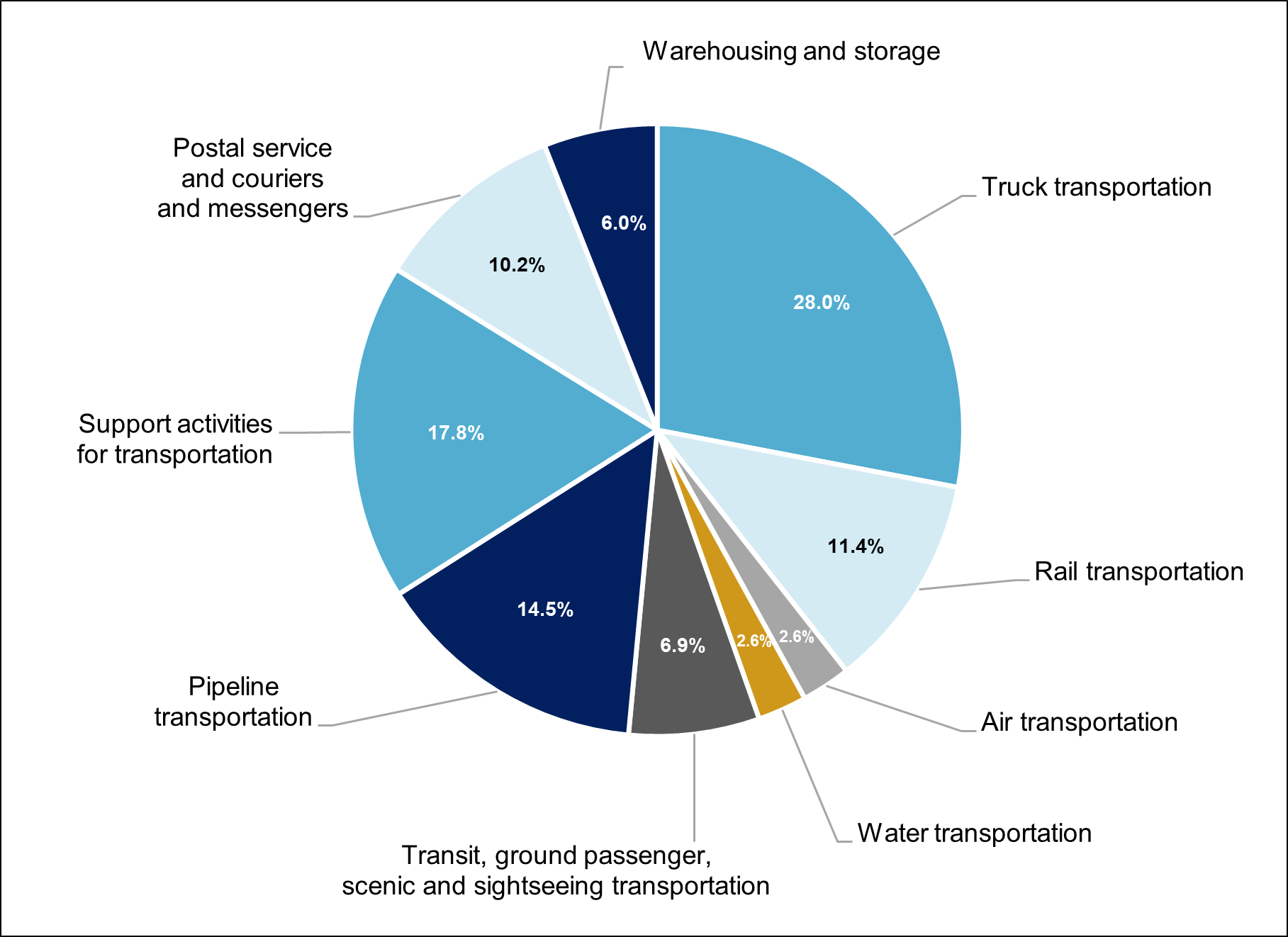

The transportation and warehousing sector is of great importance to the Canadian economy. As shown in Figure 1, in 2021, it accounted for 3.6% of Canada’s total gross domestic product (GDP)1 and engaged more than 5.2% of Canada’s workforce.2 Figure 2 shows that within Canada's transportation and warehousing GDP sector, truck transportation is the most widely used mode of transport to move goods in the country. It accounts for over 28.0% of the sector; rail transportation is the next most frequently used (11.4%), followed by air transportation (2.6%) and water transportation (2.6%). For domestic transportation, trucking was the preferred mode of transport for most goods in 2018, when 77.7% of the volume of goods transported within Canada was moved by truck, while 22.2% was moved by train and a negligible volume (0.1%) was moved by air.3 Data is unavailable for domestic marine transportation.

Figure 1 – Sectors of the Canadian Economy Contributing to Canada's Gross Domestic Product (GDP), 2021 (%)

Note: See Figure 2 for the distribution of the transportation and warehousing sector's 3.6% share of Canada's gross domestic product in 2021.

Source: Figure prepared by the Library of Parliament based on data obtained from Statistics Canada, “Table 36-10-0434-03: Gross domestic product (GDP) at basic prices, by industry, annual average (x 1,000,000),” Database, accessed 26 April 2022.

Figure 2 – Distribution of the Transportation and Warehousing Sector’s 3.6% Share of Canada's Gross Domestic Product, 2021 (%)

Source: Figure prepared by the Library of Parliament based on data obtained from Statistics Canada, “Table 36-10-0434-03: Gross domestic product (GDP) at basic prices, by industry, annual average (x 1,000,000),” Database, accessed 26 April 2022.

According to Statistics Canada, the trucking sector generated operating income that totalled more than $67 billion in 2019,4 with activities mainly concentrated in four provinces: British Columbia, Alberta, Ontario and Quebec.5

According to the studies it conducted using 2016 census data from Statistics Canada, Trucking HR Canada, an organization that offers solutions to trucking and logistics workforce challenges, estimated that 3.6% of Canada’s workforce was employed in this sector in 2019. Truck drivers represented a large proportion of workers (46%) in the trucking and logistics sector. Truck driving was largely dominated by men, with women accounting for only about 3.5% of drivers compared to 16% for the trucking and logistics sector, and 48% for all sectors of economic activity in Canada. More than one‑quarter of truck drivers (27%) were immigrants to Canada, whereas the average for all Canadian industries stood at 24%.6

Trucking HR Canada also noted that the age of drivers was markedly higher than the national average age. In 2016, 32% of drivers in the sector were 55 years old or older, compared to 21% of the Canadian labour force overall. Moreover, workers under the age of 25 accounted for only a very small proportion (3.4%) of truck drivers, even though this age range represented 12.7% of the overall labour force in Canada.7

The trucking sector is facing an acute labour shortage. Not only does the shortage of workers risk impacting the sector itself, but it also risks impacting all other sectors of the Canadian economy that depend on transportation to access domestic and international markets.

In 2020, Canada’s international trade in goods totalled roughly $1.07 trillion, down 10.9% from 2019. This decline was particularly evident in the second quarter of 2020, following the implementation of restrictive measures to combat the COVID‑19 pandemic.8

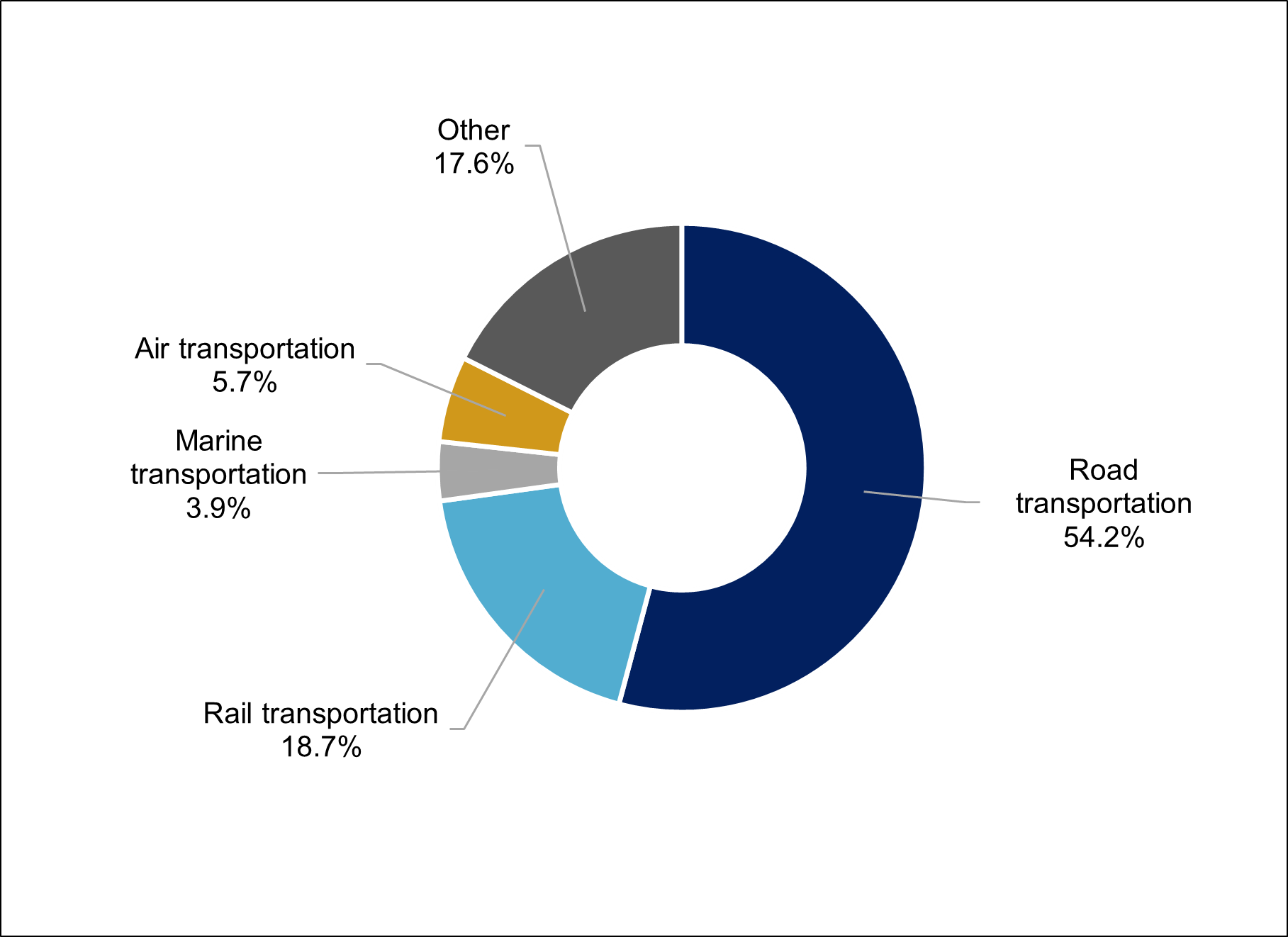

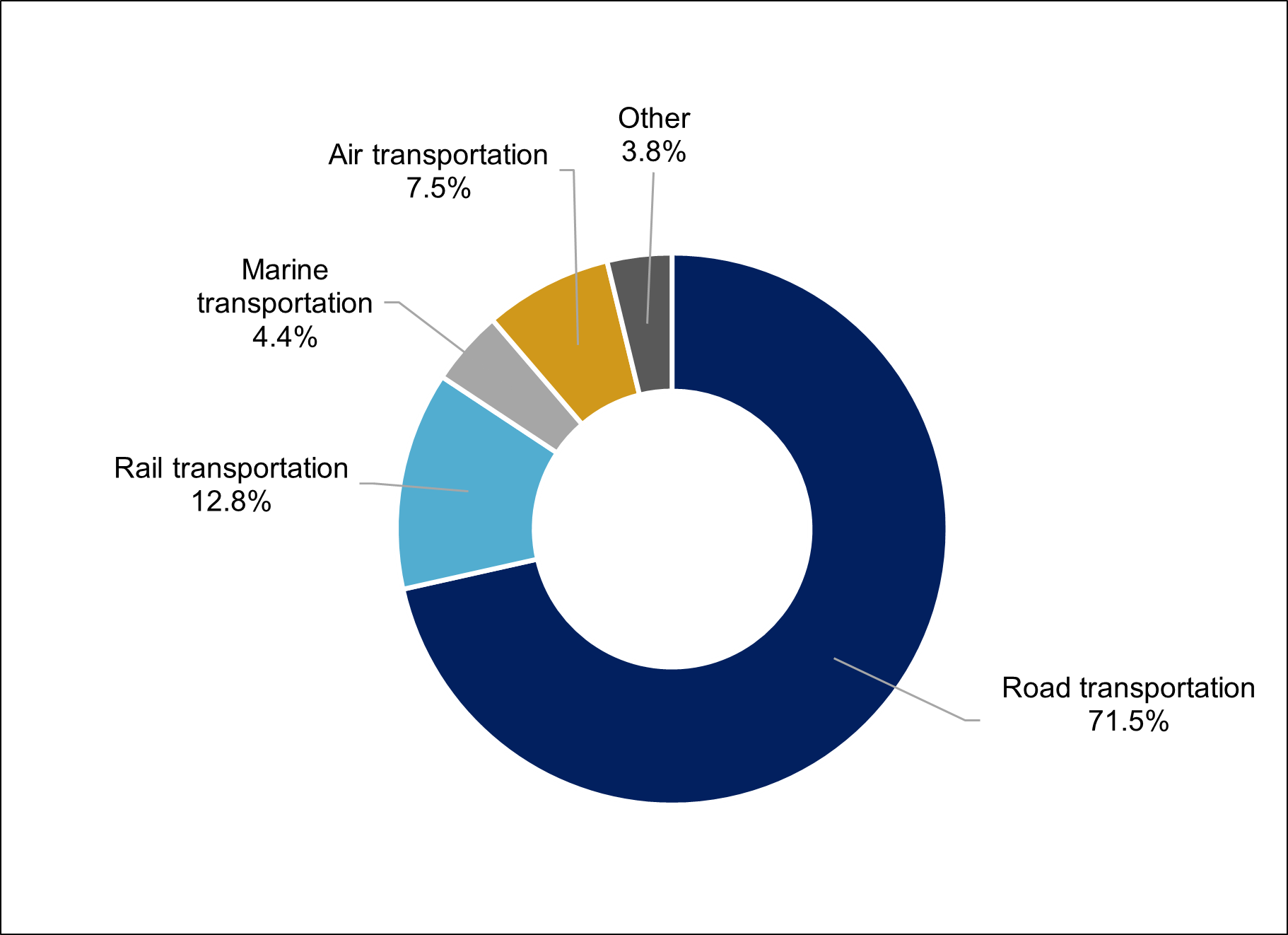

The United States is Canada’s largest trading partner. In 2020, Canadian exports to the United States totalled $384 billion and 54.2% of goods were shipped by truck (see Figure 3). Canadian imports from the United States totalled $264 billion, 71.5% of which were shipped by truck (see Figure 4). After the United States – the trade partners responsible for 60.9% of Canada’s trade – Canada’s next largest trading partners are China, Mexico, the United Kingdom and Japan. These four countries account for roughly 18% of Canada’s international trade.9

Figure 3 – Percentage of Canadian Exports to the United States by Mode of Transport, 2020

Source: Figure prepared by the Library of Parliament based on data obtained from Transport Canada, “Table EC6: Modal Shares in Canada–United States Trade, 2011–2020 – Canadian Exports to the U.S.,” Transportation in Canada: Statistical Addendum 2020 ![]() (1.26 MB, 109 pages), 2020, p. 6.

(1.26 MB, 109 pages), 2020, p. 6.

Figure 4 – Percentage of Canadian Imports from the United States, by Mode of Transport, 2020

Source: Figure prepared by the Library of Parliament based on data obtained from Transport Canada, “Table EC6: Modal Shares in Canada–United States Trade, 2011–2020 – Canadian Imports from the U.S.,” Transportation in Canada: Statistical Addendum 2020 ![]() (1.26 MB, 109 pages), 2020, p. 6.

(1.26 MB, 109 pages), 2020, p. 6.

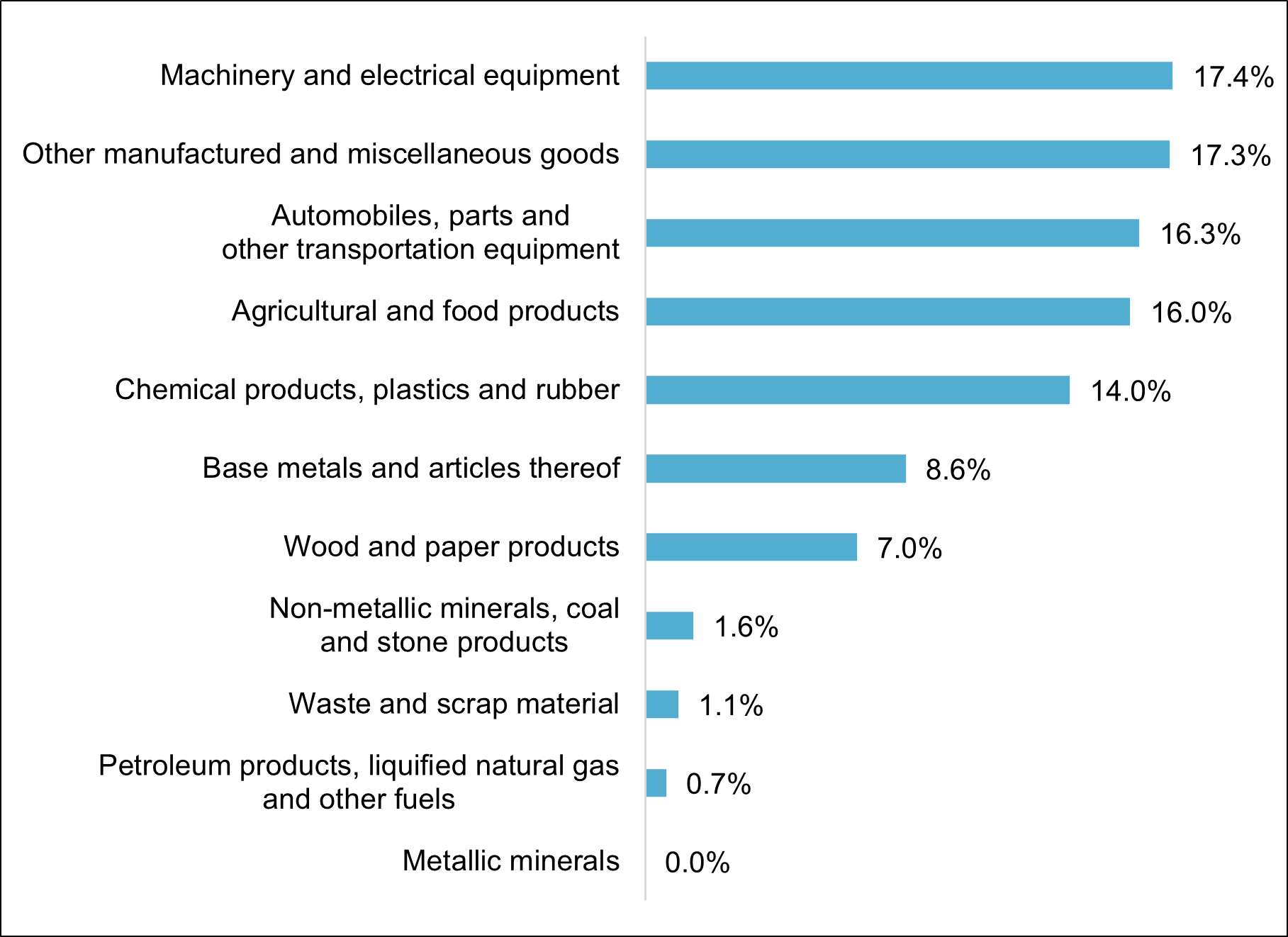

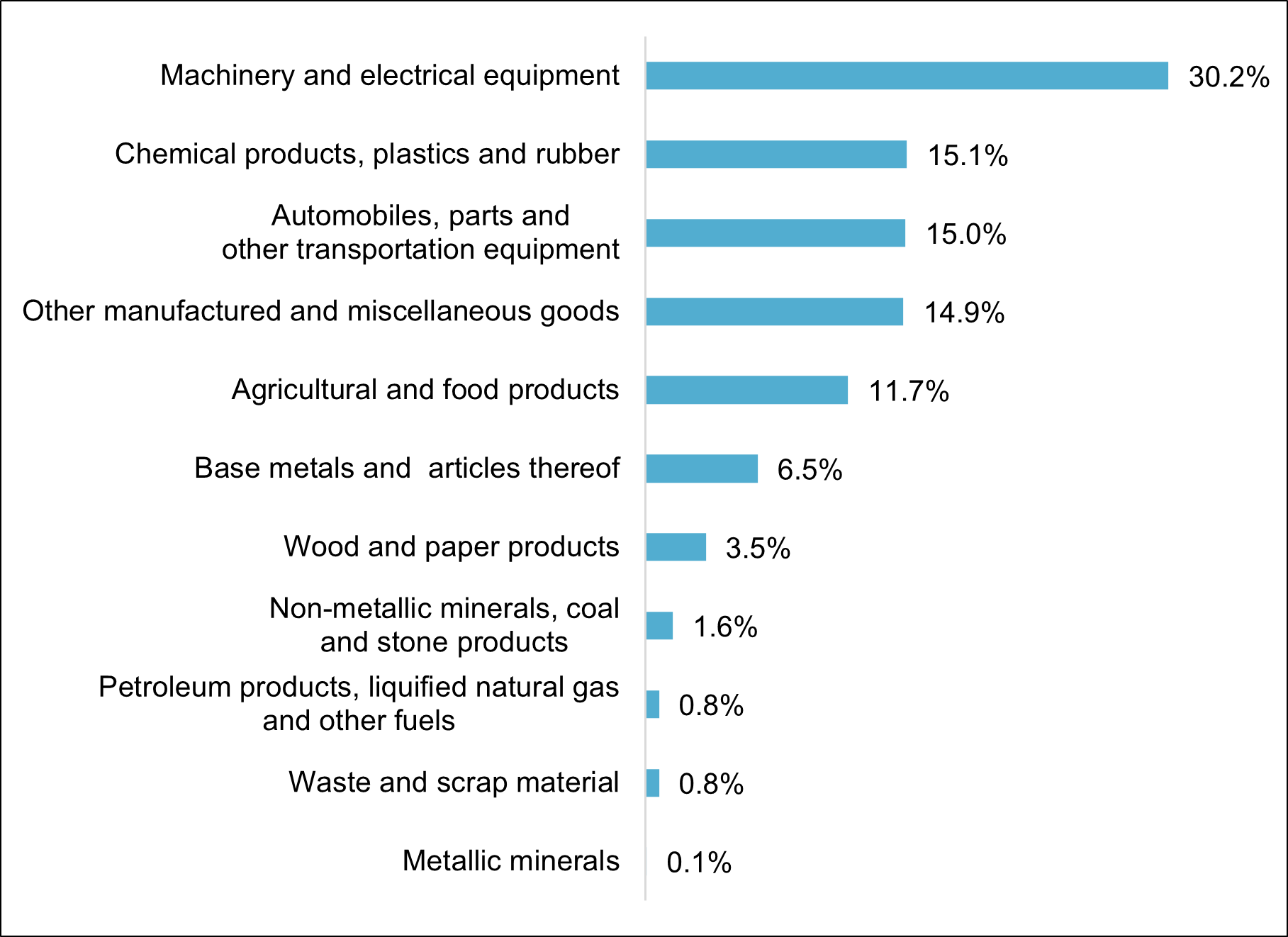

In 2020, the five main commodities shipped by truck were machinery, manufactured goods, automotive products, agri‑food products and chemical products (see figures 5 and 6). With respect to exports, 97.3% of goods transported by truck was shipped to the United States, 1.4% was shipped to Mexico and 1.4% went to other countries. In total, 65.5% of goods imported by truck came from the United States, 7.4% came from Mexico and 27.2% came from other countries.

Figure 5 – Percentage of Canadian Exports Shipped by Truck, by Commodity Group, 2020

Source: Figure prepared by the Library of Parliament based on data obtained from Transport Canada, “Table RO4: Canadian International Trade Value Shipped by Trucks, by Commodity Groups, 2019–2020 – Total Exports by trucks,” Transportation in Canada: Statistical Addendum 2020 ![]() (1.26 MB, 109 pages), 2020, p. 100.

(1.26 MB, 109 pages), 2020, p. 100.

Figure 6 – Percentage of Canadian Imports Shipped by Truck, by Commodity Group, 2020

Source: Figure prepared by the Library of Parliament based on data obtained from Transport Canada, “Table RO4: Canadian International Trade Value Shipped by Trucks, by Commodity Groups, 2019–2020 – Total Imports by trucks,” Transportation in Canada: Statistical Addendum 2020 ![]() (1.26 MB, 109 pages), 2020, p. 100.

(1.26 MB, 109 pages), 2020, p. 100.

The data on trade flows presented above shows that Canada relies heavily on trade with the United States and that goods are primarily shipped there by truck. However, commercial truckers travelling across provincial or international borders face numerous regulatory obstacles along the way.

In Canada, trucking sector activities come under the jurisdiction of all three levels of government (municipal, provincial and federal). For example, municipalities may establish their own rules by restricting routes for heavy‑vehicle traffic within their territory at different times of the day.10 Provinces and territories are largely responsible for trucking industry activities and may regulate transportation within their borders. Lastly, interprovincial and cross‑border transportation comes under federal jurisdiction.11

In order to encourage road safety, standardize safety standards across Canada and ensure efficiency in the trucking industry, the ministers responsible for transportation and highway safety prepared a memorandum of understanding for implementing the National Safety Code (NSC) and signed it in 1987.12

The Canadian regulatory framework that governs the activities of the road freight transport sector is based on the 16 standards in the NSC13 developed by members of the Canadian Council of Motor Transport Administrators (CCMTA), which comprises representatives from the federal, provincial and territorial governments in collaboration with representatives from the transport industry. The NSC establishes minimum safety standards that aim to help the trucking sector comply with local, national and international regulations.14

In order to ensure that goods are shipped efficiently and safely across the country, the trucking sector must comply with a set of rules and requirements, including limits on driving time, minimum rest periods for drivers and maximum weight and dimension criteria for heavy vehicles.

Unlike the air, marine and rail transportation sectors, the federal government does not provide extensive regulations for the road transportation sector; under the Motor Vehicle Transport Act, it delegates to the provinces the authority to build roads and the responsibility of developing regulations for their respective jurisdictions, among others.15

Both interprovincial and cross‑border transportation are subject to several regulatory regimes, which often vary from one jurisdiction to the next.16 According to the 2015 report on the review of the Canada Transportation Act, the lack of standardized regulations between different jurisdictions complicates the movement of goods and hinders economic growth in Canada. The report recommended harmonizing the policies and regulations that concern the transportation of goods between provinces and between Canada and the United States, particularly for the trucking sector.17

According to a study on internal trade in Canada by the International Monetary Fund (IMF), the overlapping regulations in the different provinces and territories create trade barriers that limit the free movement of goods within the country.18

For example, technical barriers, such as regulations on the size and maximum weight of trucks, prevent Canadian businesses from transporting goods efficiently across the country. Carriers who cross provincial borders need several permits from different provinces. Even though the provinces do not impose customs tariffs, a 2019 study by Statistics Canada estimated that interprovincial trade barriers amounted to the equivalent of a 10% tariff.19 The IMF estimates that a complete liberalization of internal trade in Canada could increase the country’s GDP by 4%.20

In order to improve the flow of internal trade, several initiatives meant to harmonize regulations have been implemented in recent decades, notably the Federal‑Provincial‑Territorial Memorandum of Understanding on Interprovincial Weights and Dimensions, adopted in February 1988.21 Subsequently, the Agreement on Internal Trade (AIT), meant to reduce interprovincial trade barriers, went into effect in 1995, followed by the Canadian Free‑Trade Agreement, an improved version of the AIT, in 2017.22

Some provinces also formed regional trade partnerships in order to facilitate trade between them, such as the New West Partnership Trade Agreement in western Canada, and the Trade and Cooperation Agreement between Ontario and Quebec. Despite these efforts, stakeholders in the road transportation sector point out that trade barriers persist and that these regional agreements exclude several provinces and territories.

In 2016, the Council of Minister Responsible for Transportation and Highway Safety (COMT) created the Task Force on Trucking Harmonization to identify barriers that impede the flow of trade across Canada. In 2019, the Task Force published Supporting the Efficient Movement of Trucks Across Canada: Suggested Approaches by the Task Force on Trucking Harmonization, a report that identifies trade irritants and suggests approaches for trucking goods across the country more efficiently. The report lists a number of irritants, including the absence of harmonization between jurisdictions for legal vehicle weights and dimensions, lack of consistency in adopting NSC standards, absence of harmonization in processes for issuing permits, differences in weight allowances based on tire size and lack of a national strategy for safe rest areas.23

The COMT also launched the Pan‑Canadian Competitive Trade Corridor Initiative (PCCTC). The work of the PCCTC Task Force will span two years (2020 to 2022). This initiative is meant to improve the reliability and efficiency of Canada’s transportation corridors to Canadian and international markets.24

Not only is Canada’s largest trading partner the United States, but the two countries share the longest land border in the world which is 8,890 kilometres long.25

At the Canada–United States border, the trade barriers that stem from “divergent regulations, red tape, border‑related delivery delays and policy uncertainty”26 are key sources of trade friction. Statistics Canada estimates that these frictions represent the equivalent of a 30% tariff.27

On average, approximately 30,000 trucks cross the Canada–United States border on a daily basis.28 When crossing international borders, road freight companies are subject to a set of regulations established by the countries in which they do business.29 At the Canada–United States border, trucking companies must comply with the rules and requirements established by United States Customs and Border Protection, the United States Department of Homeland Security and the Canada Border Services Agency.

Canada and the United States have a long history of working together to facilitate the movement of people and goods without compromising border safety. Over the past few years, considerable efforts have been made on both sides of the border to harmonize regulations concerning the transportation of goods and hazardous materials. Canada regularly updates its Transportation of Dangerous Goods Regulations in order to harmonize them with the United Nations Model Regulations and regulations in the United States.30

Another example of harmonizing Canadian regulations with those in the United States is the making of federal regulations concerning electronic logging devices (ELDs) to ensure compliance with regulations on drivers’ hours of service. The regulations concerning ELDs essentially aim to reduce fatigue and accidents. They went into effect on 12 June 2021 in Canada, while similar regulations have been in place in the United States since 18 December 2017.31 For now, the use of ELDs is mandatory only for federally regulated carriers which benefit from a penalty‑free transitional period until 12 June 2022.32 However, the CCMTA announced on 7 March 2022 that this transitional period had been extended until January 2023.33

The figures presented above illustrate the trucking sector’s great importance to the Canadian economy. However, the sector is also facing a number of challenges related to health, human and environmental concerns.

Many economic sectors around the world were hit hard by the COVID‑19 pandemic. The road freight transport sector was not spared by the global health crisis.

Even though the transportation sector is an essential service, business for some road transportation companies slowed as a result of a drop in demand for certain goods, while other companies saw an increase in activity (for example, transporting medical equipment, food and other essential products).34

According to a survey by Trucking HR Canada, most companies in the trucking and logistics sector laid off employees because of the pandemic. Drivers were hit harder by layoffs than employees who perform other work. The survey also found that the number of layoffs was higher for short‑haul drivers (10.8%) than for long‑haul drivers (8%).35 Women and young workers were hit hardest by these layoffs, especially at the beginning of the pandemic.36

The COVID‑19 pandemic disrupted the operations of many transportation companies and consequently forced these companies to re‑evaluate their practices. Trucking companies will have to adjust to the new post‑pandemic reality to ensure a properly functioning supply chain and the safety of their employees.37 Major technological changes are underway in the transportation and logistics sector. Many companies in the sector have stated that they plan to increase their investments in technological solutions,38 for example, by digitizing trucking to better manage their operations.39

In light of the key role that trucking plays in the supply chain, the shortage of truckers has a major impact on all economic activities across Canada. Even though staffing shortages are not new, the pandemic has exacerbated this labour problem, which could impede the country’s economic recovery.

According to a study conducted by Trucking HR Canada, Canada could be facing a shortage of up to 25,000 truck drivers by 202540 due to difficulties recruiting truckers, particularly women, to replace retiring truck drivers. The other issue contributing to this increasing shortage is the high turnover rate, especially among long‑haul truckers, who often have to be away from home for extended periods of time, making it difficult to achieve work–life balance.41 High training costs may also present a barrier to the trucking profession.

Trucking industry stakeholders have proposed a number of solutions, including a strategy for promoting the trucking profession among women, future drivers, Indigenous communities and immigrants to help fill vacancies. For example, a number of initiatives have been put in place to increase diversity in the trucking sector, such as the Women with Drive initiative and the Women’s Trucking Federation of Canada, an organization established to encourage women to choose trucking as a career.42 Business networks, like Northern Resource Trucking, seek to attract Indigenous workers to this sector.

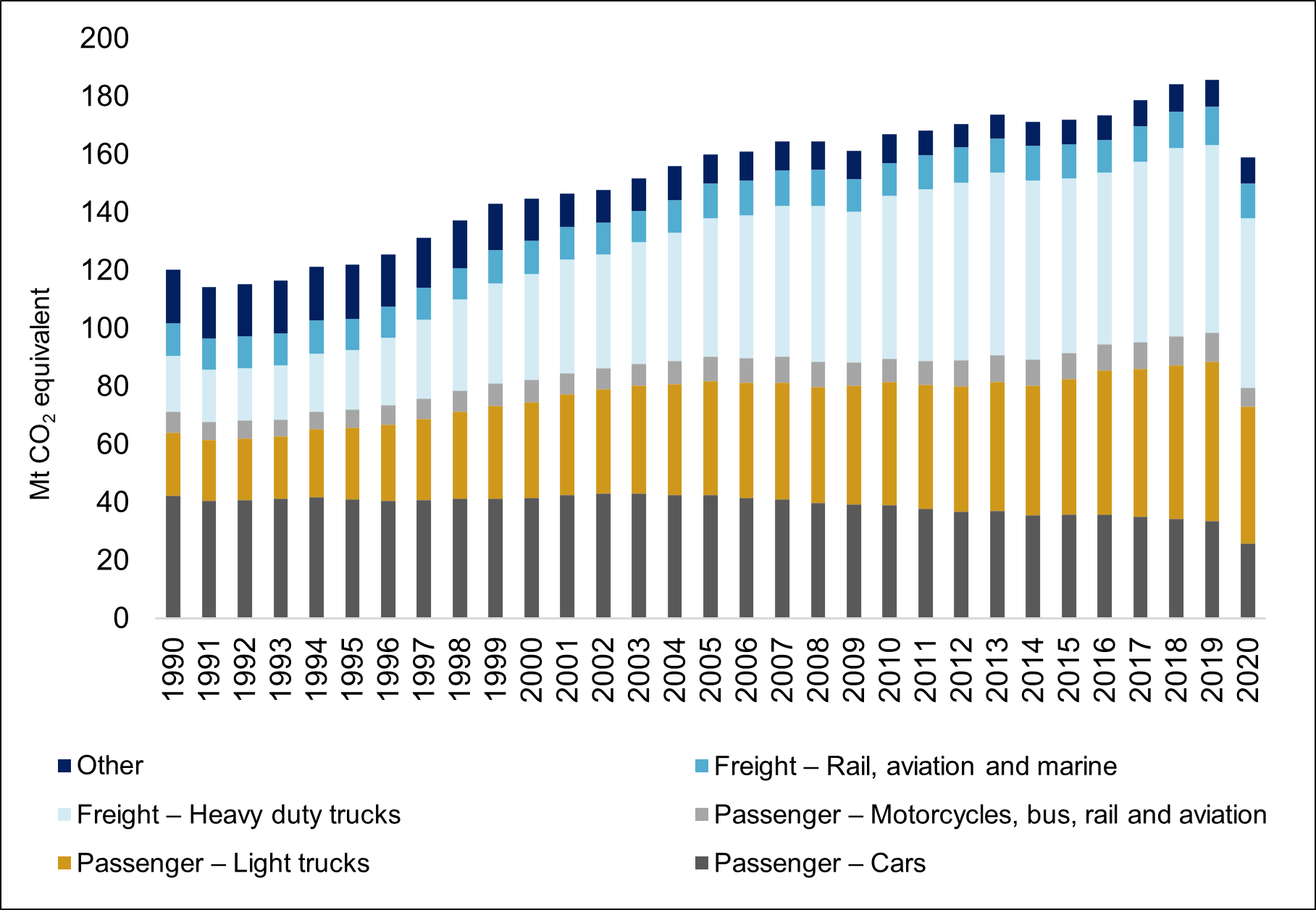

While the transportation of goods by truck plays a key role in the economy, it is also a major source of pollution. In 2020, it accounted for 36.7% of the greenhouse gas (GHG) emissions produced by Canada’s transport sector, which is approximately 8.7% of total GHG emissions in Canada.43 Between 1990 and 2020, GHG emissions from heavy‑duty freight trucks more than tripled, from 19.4 megatons of carbon dioxide equivalent (Mt CO2 eq) to 58.5 Mt CO2 eq (see Figure 7). This change, along with increases in the passenger light truck category, contributed significantly to the overall rise in emissions from the transport sector. Despite the notable drop in GHG emissions from the sector in 2020, during the period at issue, freight trucking alone has produced more emissions than rail, aviation and marine freight combined, which only showed a slight increase.

Figure 7 – Greenhouse Gas Emissions Produced by Canada’s Transportation Sector, in megatons of carbon dioxide equivalent (Mt CO2 eq), 1990 to 2020

Source: Figure prepared by the Library of Parliament using data obtained from Environment and Climate Change Canada, Greenhouse Gas Emissions: Canadian Environmental Sustainability Indicators ![]() (1.15 MB, 23 pages), April 2021.

(1.15 MB, 23 pages), April 2021.

To achieve the international climate goals set out in the United Nations Framework Convention on Climate Change and the Paris Agreement, it will be essential to considerably reduce the carbon footprint made by road transport by 2050 and transition to zero‑emission electric vehicles.

As a signatory to the Paris Agreement, Canada has committed to reducing its emissions by 40% to 45% below 2005 levels, by 2030.44 At the federal level, the Canadian Net‑Zero Accountability Act requires the Government of Canada to set national targets for reducing GHG emissions and establishes a planning, reporting and assessment process that seeks to achieve net‑zero emissions by 2050. The Act received Royal Assent on 29 June 2021.

Ahead of the 2021 United Nations Climate Change Conference (COP26), the COP26 Presidency hosted the first Zero Emission Vehicles Transition Council (ZEVTC) in November 2020 to discuss ways to accelerate the pace of the global transition to zero‑emission vehicles, to reduce emissions and help the global economy meet the Paris Agreement goals.45 The ZEVTC was made up of ministers and representatives from California, Canada, Denmark, the European Commission, France, India, Italy, Japan, Mexico, the Netherlands, Norway, South Korea, Spain, Sweden and the United Kingdom.

Canada is currently the co‑chair of the Climate and Clean Air Coalition (CCAC), a voluntary coalition of countries and organizations working together to reduce emissions of short‑lived climate pollutants (SLCPs). Since its launch in February 2012, the CCAC has been working to implement actions to reduce SLCPs in several sectors, including heavy‑duty diesel vehicles and engines.46 Canada is also one of many countries preparing an action plan for global green transportation as part of the Climate and Clean Air Coalition and the United Nations Environment Programme. The plan encourages collaboration to make the global movement of freight more efficient in order to reduce its climate impact.47

Many observers consider accelerating the transition to electric vehicles (EVs) a necessary step to achieve net‑zero emissions by 2050. Although EV technology is commonly associated with automobiles and light trucks, recent studies have examined possible scenarios in which long‑distance medium‑ and heavy‑duty vehicles would take part in the transition to net‑zero emissions.48 There are four main types of EVs:49

Currently, biofuels are the main viable commercial alternative to diesel,50 but only BEVs and hydrogen‑powered FCEVs have the potential to significantly reduce GHG emissions.51 To date, however, BEV and FCEV technologies are not commercially viable options for long‑distance heavy freight trucks due to battery density, charging requirements and driving range limitations. Nevertheless, this could change with the development of new battery technologies and high‑power charging infrastructure.

Certain initiatives already underway could help Canadian companies achieve net‑zero emissions by 2050. For instance, Hydro One will be receiving $4.95 million through Natural Resources Canada’s Electric Vehicle Infrastructure Demonstration Program to develop a pilot project to install charging stations in Ontario for heavy‑duty electric trucks. The project will serve as a model that could be used by other utilities and businesses.52

On the supplier side, the availability of zero‑emission freight vehicles in Canada and the United States is expected to increase to at least 85 models from over 30 companies.53 This includes vehicles from Lion Electric Co., Arrival, Rivian, Volvo Trucks, Kenworth, Peterbilt and Workhorse.

On the buyer side, Canadian companies such as IKEA Canada, Metro Supply Chain Group, Groupe Morneau, Mosaic Forest Management and Walmart Canada have announced their respective purchases of zero‑emission heavy‑duty trucks as part of their effort to prioritize sustainability.54

To date, British Columbia and Quebec are the only provinces that offer rebates on the purchase of heavy‑duty electric trucks. British Columbia’s CleanBC Go Electric Specialty Use Vehicle Incentive program offers up to $100,000, whereas Quebec’s Écocamionnage program offers $175,000 per vehicle.55

© Library of Parliament