With the majority of grains produced in Western Canada intended for export, the grain trade relies on a complex supply chain in which rail transportation is the cornerstone. Rail makes it possible to cover the vast distances between grain elevators where farmers deliver their grain and the port terminals from where grain is shipped to international markets. Most grain rail traffic is bound for the ports of Vancouver, Thunder Bay and Prince Rupert.

Given the predominance of rail in grain transportation, Parliament was compelled very early on to take action to ensure that grain farmers could sell their goods. Today, the federal legislative framework covers both charges and the terms and conditions for interswitching, farmers’ ability to access competing railways. Recurring bottlenecks in rail transportation over the last decade have led to a series of reforms, adopted to improve the fluidity of logistics in grain movement. In particular, these reforms have been aimed at broadening the transparency requirements for railway companies and extending the interswitching distances.

The grain transportation system faces multiple present-day challenges. In addition to being captive to a limited number of railway companies, producers face a global consolidation of grain-trading companies, which impedes their bargaining power. Other concerns could prevent railway companies from operating at full capacity, for example, labour shortages in rail transportation and labour disputes. Lastly, climate change is also likely to drive the proliferation of extreme weather events that can cause delays in the rail transportation system.

Canada’s Prairies comprise one of the world’s major breadbaskets and accounts for nearly three-quarters of Canadian grain production. Unlike grain grown in other regions around the world, Western Canadian grain travels relatively long distances, between 1,400 km and 2,000 km, and crosses considerable natural barriers, such as the Rocky Mountains,1 to reach its destination. Thus, the grain sector relies on rail transport to deliver product to its destination.

This document provides an overview of grain handling in Western Canada, its legislative framework, as well as emerging issues and challenges the grain transportation system faces.

The area suitable for growing grain in Western Canada spans the provinces of Manitoba, Saskatchewan and Alberta and a section of British Columbia.2 Historically, production has largely exceeded demand, pushing farmers toward export markets.

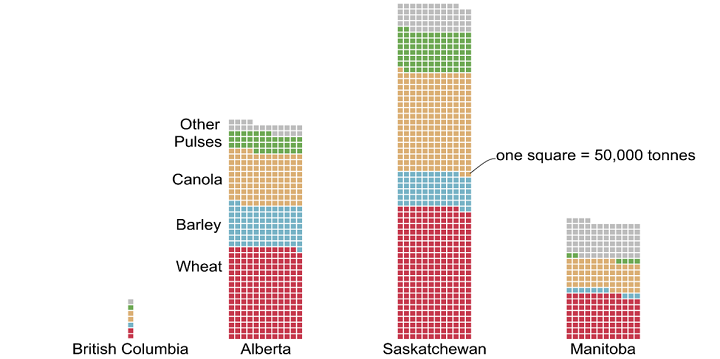

Saskatchewan is the top producer of grains, particularly pulses and durum wheat.3 It is followed by Alberta which specializes more in spring wheat and barley. In each of these provinces, canola is the leading or second crop by volume (see Figure 1).

Figure 1 – Primary Grains Produced in Western Canadian Provinces (Annual Average, from 2017 to 2022)

Source: Figure prepared by the Library of Parliament using data obtained from Statistics Canada, “Table 32-10-0013-01: Supply and disposition of grains in Canada (x 1,000),” Database, accessed 28 July 2023.

Approximately 70% of the grain produced in Western Canada is exported to international markets. Export destinations vary from one type of grain to another (see Table 1).

| Rank | Common Wheat | Durum Wheat | Canola | Pulses | Barley |

|---|---|---|---|---|---|

| 1 | China – 771 | Morocco – 402 | China – 2,313 | China – 894 | China – 752 |

| 2 | Indonesia – 748 | Algeria – 401 | Japan – 1,585 | India – 603 | United States – 92 |

| 3 | Japan – 679 | Italy – 375 | Mexico – 1,017 | United States – 345 | Japan – 78 |

| 4 | United States – 565 | United States – 286 | United Arab Emirates – 456 | Turkey – 330 | Kuwait – 12 |

| 5 | Colombia – 476 | Japan – 101 | Pakistan – 404 | Bangladesh – 264 | Saudi Arabia – 8 |

| Total | 6,976 | 2,126 | 6,975 | 3,988 | 952 |

Source: Table prepared by the Library of Parliament using data obtained from Statistics Canada, “Canadian International Merchandise Trade Web Application,” Database, accessed 28 July 2023.

Grain export markets can change significantly over time. For example, the United Kingdom, Soviet Union and United States have been key trade partners with Canada at various times in its history.4 More recently, grain farmers have had to adapt to disruptions in demand, such as in 2019 when China restricted imports of Canadian canola,5 and in 2022 when Russia’s invasion of Ukraine drove up demand for Canadian wheat.6

According to the Canada Transportation Act Review Report,7 the movement of grain from Western Canada to export markets is marked by the central role that rail plays, moving 94% of grain exports. This share is significantly higher than in other countries like the United States, where 46% of the grain exported is transported by barge, and only 38% is transported by rail.8

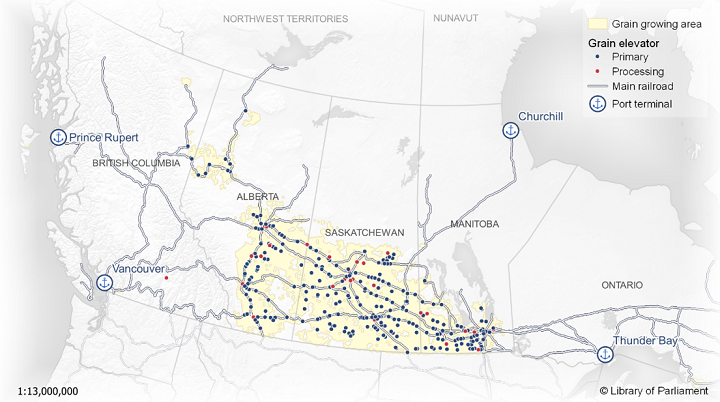

In Western Canada, while truck transport has a limited role in reaching the ports, it plays a key role locally in transporting grain between farms and grain elevators. These grain elevators are also important in the movement of grain as they facilitate both grain storage and the loading of freight cars.9 In 2023, there were 353 primary grain elevators and 52 process elevators, which are elevators that supply facilities like flour mills and oilseed crushing plants.10

Under the Canada Grain Act,11 grain elevators are owned by private businesses or farming co-operatives that must be licensed by the Canadian Grain Commission (CGC)12 which may, in particular, cap the maximum charges in effect set by the companies and oversee the inspection and sampling of grain during the loading of elevators.13

The grain then travels by rail to ports. Two national railway companies – the Canadian National Railway Company (CN) and the Canadian Pacific Railway Company (CP)14 – control 85% of the railway system in Western Canada, while short-line railways control the remaining 15%.15 The four ports that serve Western Canada, namely, the ports of Vancouver, Prince Rupert, Thunder Bay and Churchill, receive approximately 78% of grain rail freight, and consequently, constitute key infrastructure in the regional logistics system16 (see Figure 2).

Figure 2 – Grain Growing Areas and Handling and Transportation Infrastructure

Sources: Map prepared by the Library of Parliament in 2023 using data obtained from Government of Canada, “Grain Elevators in Canada,” Database, accessed 28 July 2023; Government of Canada, “Annual Crop Inventory,” Database, accessed 28 July 2023; Natural Earth, 1:10m Cultural Vectors, version 5.1.1; Natural Earth, 1:10m Physical Vectors, version 5.1.1; and Natural Earth, 1:10m Raster Data, version 5.1.1. Software used: QGIS.

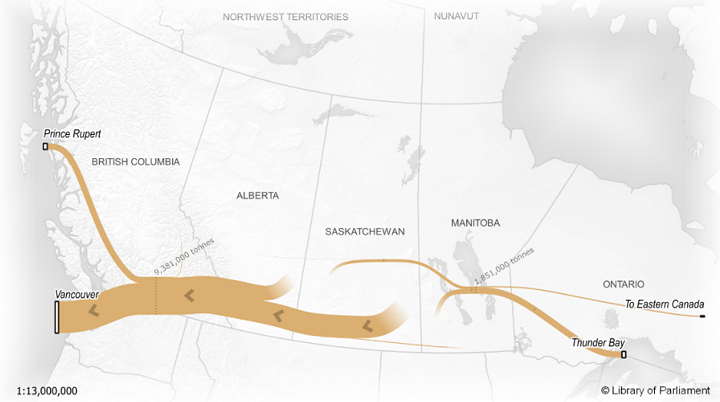

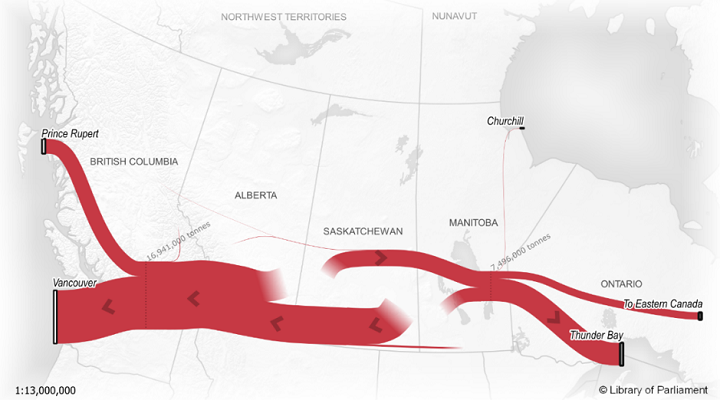

Grain is mainly transported to ports on the Pacific coast. The Port of Vancouver alone funnels more than half the total grain volume from Western Canada and the majority of canola, wheat and barley shipments to China and Japan, and lentils to India. The Port of Prince Rupert also provides another outlet to the Pacific and currently receives approximately 10% of the grain intended for export.17

Some of the grain is moved from west to east, toward the Great Lakes and St. Lawrence Seaway ports, which are better positioned to serve Africa and Europe. The Port of Thunder Bay is the main outlet for these shipments and receives 14% of grain shipments by rail, particularly durum wheat destined for Italy and the Maghreb (see Figures 3 and 4).

Figure 3 – Flows of Canola Transported by Rail to Canadian Ports, by Volume (Average from 2017 to 2022)

Note: In this figure, “canola” includes bulk canola, canola meal and canola oil. Given the absence of disaggregated data by commodity, the flows by railway transportation to the United States are not represented.

Sources: Map prepared by the Library of Parliament in 2023 using data obtained from Quorum Corporation, “Grain Monitor Program,” Database, accessed 20 June 2023; Natural Earth, 1:10m Cultural Vectors, version 5.1.1; and Natural Earth, 1:10m Physical Vectors, version 5.1.1. Software used: QGIS and Inkscape.

Figure 4 – Flows of Main Cereals Transported by Railway Freight to Canadian Ports, by Volume (Average from 2017 to 2022)

Note: In this figure, “grains” include wheat, durum wheat, barley, oats and rye; canola includes shipments of bulk canola, canola meal and canola oil. In the absence of disaggregated data by commodity, rail freight flows to the United States are not shown.

Sources: Map prepared by the Library of Parliament in 2023 using data obtained from Quorum Corporation, “Grain Monitor Program,” Database, accessed 20 June 2023; Natural Earth, 1:10m Cultural Vectors, version 5.1.1, accessed 20 June 2023; and Natural Earth, 1:10m Physical Vectors, version 5.1.1, accessed 20 June 2023. Software used: QGIS and Inkscape.

Until 2016, when it was shut down, the Port of Churchill provided an additional outlet to the Arctic. The port reopened in 2018 after the Arctic Gateway Group took it over. This consortium also owns 1,300 km of railway that connects the port to other parts of Manitoba. From its reopening in 2018 until 2022, the port received mostly wheat in limited quantities. Lastly, approximately 13% of railway grain shipments cross the United States border by rail.18

For more than a century, shippers of goods have had the right to obtain rail services in Canada. Railway companies are bound by “common carrier obligations” to provide a suitable level of service to move these goods to their destinations.19

In Canada, the legislative framework that covers grain transportation by rail dates back to the 19th century, when the federal government adopted the Crow’s Nest Pass Agreement in response to the problems grain farmers faced in Western Canada, for example, a harsh climate and a railway monopoly.20

The agreement constituted an arrangement whereby the Government of Canada provided a subsidy to CP for the construction of its rail line through the Rocky Mountains in return for reduced rates to transport grain.21 This agreement would have far-reaching consequences for railway regulation in Western Canada for many decades.22

In 1983, the Western Grain Transportation Act (WGTA) replaced this agreement and instituted a direct subsidy for grain export. In 1995, the WGTA was repealed, marking the end of the subsidy under the requirements of the General Agreement on Tariffs and Trade,23 which paved the way for establishing the World Trade Organization.24 Since 1996, the Canada Transportation Act25 has prescribed requirements for grain transportation by rail.26

Under the Canada Transportation Act, the Canadian Transportation Agency27 sets the annual maximum revenue entitlement (MRE)28 of each railway company for the movement of grain in Western Canada. Essentially, the MRE is a form of economic regulation that limits the total annual revenue that railway companies can receive for transporting grain. The MRE is determined based on various factors set out in the Canada Transportation Act. Under this Act, railways are free to set rates for their services, provided that the total amount collected to move Western grain does not exceed the revenue limit set by the Canadian Transportation Agency.29

Many stakeholders in the grain sector depend on transportation services. Grain shippers are captive to this mode of transportation and often reliant on a single railway company.

Regulated since 1904, interswitching is a mechanism that helps give shippers fair and reasonable access to rail services in a captive railway market.30 According to the Canadian Transportation Agency:

Interswitching is the transfer of traffic between two railway companies (railways). One railway takes a shipper’s freight part of the way between origin and destination. It then transfers the freight to a competing railway with which the shipper has made arrangements for the rest of the haul. The transfer takes place at an interchange – where the lines of the two railways meet.31

In general, interswitching is available to shippers located within 30 km of an interchange. However, the Canadian Transportation Agency can prescribe different distances for the purpose of interswitching. By exercising its statutory powers under section 128 of the Canada Transportation Act, the Agency may:

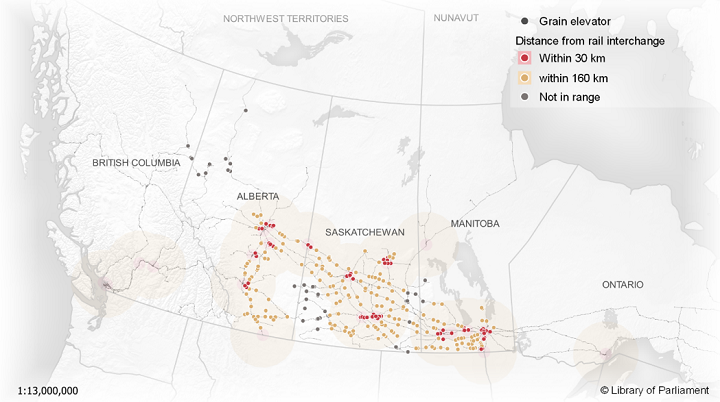

Given that grain is loaded onto trains from grain elevators, the distance between the elevator and the locations of interchanges is what determines a shipper’s eligibility to use the services of another railway company. The map in Figure 5 shows the estimated interswitch eligibility of grain elevators in northern Alberta. The CN and CP networks intersect at several points, comprising interchanges, such as around Edmonton and Camrose. Grain elevators near these two cities have interswitch access within 30 km.

Several bills introduced in Parliament, which are discussed in the next section, have proposed increasing the interswitching distance to 160 km. At this distance, new grain elevators become eligible for interswitching, such as those located near Vegreville. Some grain elevators, for example, those near Grande Prairie, remain ineligible for interswitching regardless of whether the distance is 30 km or 160 km.

Figure 5 – Estimated Interswitch Eligibility in Northern Alberta Based on Interchange Distance

Note: Interchanges were inferred from the intersections between the two railways and cross-referenced with the lists made available by Canadian National and Canadian Pacific. The accuracy of the data cannot be guaranteed.

Sources: Map prepared by the Library of Parliament in 2023 using data obtained from Government of Canada, “Grain Elevators in Canada,” Database, accessed 20 June 2023; Canadian Pacific Kansas City, CTA Interswitching Locations; Canadian National, CTA Interswitching Points – Canada; Government of Canada, “National Railway Network – NRWN – GeoBase Series,” Database, accessed 20 June 2023; Natural Earth, 1:10m Cultural Vectors, version 5.1.1; and Natural Earth, 1:10m Physical Vectors, version 5.1.1. Software used: QGIS.

In recent years, the grain sector has faced multiple challenges, in particular, rail transportation bottlenecks during the 2013–2014 crop year. According to the grain sector, delayed shipments of agricultural products has caused significant financial losses in the Canadian economy. The grain sector has urged the federal government to take action to improve rail service performance.33

A record crop combined with an exceptionally severe winter posed difficulties for the railway system during the 2013–2014 crop year, causing significant delays in freight delivery.34

To address this situation, the government introduced Bill C-30, An Act to amend the Canada Grain Act and the Canada Transportation Act and to provide for other measures (short title: Fair Rail for Grain Farmers Act)35 in March 2014. The bill received Royal Assent on 29 May 2014. The purpose of the Fair Rail for Grain Farmers Act was to move grain to market faster and more efficiently by increasing supply chain transparency, in particular, by sharing more information and strengthening the contracts between producers and shippers. This Act also contained provisions that required railways to move minimum quantities of grain per week. It also gave the Canadian Transportation Agency authority to extend interswitching distances from 30 km to 160 km in the Prairie provinces.36

While the provisions of this Act mitigated rail service issues and improved the competitiveness of the transportation system, these emergency measures were a temporary solution only and expired on 1 August 2017.37

A record harvest and a harsh 2013–2014 winter paved the way for an accelerated review of the Canada Transportation Act, in order to clear the grain transportation backlog.38 Following this review and public consultations, in November 2016, the federal government released the strategic plan for the future of transportation in Canada – Transportation 2030: A Strategic Plan for the Future of Transportation in Canada39 – that is intended to strengthen the competitiveness and efficiency of the national transportation system for the long term.40

With the goal of improving the efficiency of freight rail transportation, the federal government introduced Bill C-49, An Act to amend the Canada Transportation Act and other Acts respecting transportation and to make related and consequential amendments to other Acts (short title: Transportation Modernization Act),41 which received Royal Assent on 23 May 2018. The provisions of the Transportation Modernization Act seek to help shippers and grain farmers by supporting a transparent, fair, efficient and safe national freight rail system. Under this Act, reciprocal penalties can be imposed between rail companies and grain shippers for poor service. It also contains provisions on the MRE for the movement of grain and the use of an alternative railway via long haul interswitching, in addition to provisions for increased transparency in railway companies’ records.42

On 20 April 2023, the federal government tabled Bill C-47, An Act to implement certain provisions of the budget tabled in Parliament on March 28, 2023 (short title: Budget Implementation Act, 2023, No. 1),43 which received Royal Assent on 22 June 2023. Division 22 in Part 4 of the Budget Implementation Act, 2023, No. 1, amends the Canada Transportation Act to permit information sharing for the proper functioning of the national transportation system. This amendment also expands the radius in which the Canadian Transportation Agency may order interswitching, extending the distance from 30 km to 160 km from an interchange.

Figure 6 shows estimated impact of expanding the interswitching radius on grain-elevator eligibility under this mechanism.

Figure 6 – Estimated Grain Elevator Interswitch Eligibility Based on Interchange Distance

Note: Interchanges are inferred from the intersections between the two railways and cross-referenced with the lists made available by Canadian National and Canadian Pacific. The accuracy of the data cannot be guaranteed.

Sources: Map prepared by the Library of Parliament in 2023 using data obtained from Government of Canada, “Grain Elevators in Canada,” Database, accessed 20 June 2023; Canadian Pacific Kansas City, CTA Interswitching Locations; Canadian National, CTA Interswitching Points – Canada; Government of Canada, “National Railway Network – NRWN – GeoBase Series,” Database, accessed 20 June 2023; Natural Earth, 1:10m Cultural Vectors, version 5.1.1; and Natural Earth, 1:10m Physical Vectors, version 5.1.1. Software used: QGIS.

International grain trading has always been dominated by four large multinational firms, sometimes referred to as the ABCD firms, for the first initial of their names: Archer Daniels Midland Company (headquartered in Chicago, United States); Bunge Limited (St. Louis, United States), Cargill (Minnetonka, United States); and Louis Dreyfus Company (Rotterdam, Netherlands). Estimates suggest that these firms control 50% to 90% of the international grain market.44

An important emerging powerhouse in this industry is the China National Cereals, Oil and Foodstuffs Corporation (COFCO International), a Chinese state-owned enterprise that gained a foothold in the international grain trade in 2014 with its acquisition of both Nobel Agri, the agricultural division of the Hong Kong-based Nobel Group, and Dutch grain firm Nidera. COFCO International now owns and operates a sizable portfolio of ports, terminals and storage facilities in several grain producing regions.45

Under the Canada Grain Act, the CGC is responsible for licensing companies that handle and process Canadian grain. The CGC has licensed each of the ABCD firms to operate grain facilities in Canada, but only Cargill ranks among the seven largest Canadian firms in terms of overall grain-holding capacity. This situation may, however, change if Bunge Limited acquires Viterra, the single-desk grain marketer from 1926 to 2012, formerly known as the Saskatchewan Wheat Pool.46

Currently, the seven largest grain handling firms in Canada are: Cargill Limited, Parrish & Heimbecker Limited, Paterson Grain, Richardson International, Viterra Inc., G3 Canada Limited and GrainsConnect Canada. According to Quorum Corporation, these seven firms control 55% of Canadian grain handling and transport system facilities and 76.3% of its storage capacity.47 Since the dissolution of the Canadian Wheat Board (CWB) in 2012, many of these firms have sought to vertically integrate their operations, acting as both grain buyers, processors and exporters. This consolidation created efficiencies in the system, particularly in transport and logistics, and it allowed Canada to expand its grain exports, but it also caused concern among some producers that the system is not operating competitively.48

The Canadian grain sector is less concentrated than many of its international counterparts; in Australia, for example, as much as 85% of the country’s bulk grain exports travelled through the port network of GrainCorp in 2014.49 A higher concentration in the Canadian grain sector after abolishing single-desk grain marketing in 2012 has nevertheless had important consequences for participants. Some grain farmers have expressed concern that this higher concentration has impeded their ability to access the transportation network competitively. In their view, the concentration of holding capacity has led firms to consolidate their grain elevator networks, increasing transport costs for producers and, in some cases, causing them to be “captive” to the nearest grain elevator and whatever grain price its operators choose to offer producers.

Some studies have described the current grain sector as one that has, at times, exercised “near cartel-like” powers over producers.50 In contrast, others note that the sector is competitive and has greatly improved since the days of provincial wheat pools, allowing producers, for example, to grow different varieties of grains and access new and emerging specialty grain markets.51

Grain elevators play an important role in the grain handling and transport system, and their potential consolidation has also given rise to concerns. Before the dissolution of the CWB in 2012, farmers would deliver their grain to a designated country elevator where it entered the common provincial grain pool. Farmers were paid an initial amount based on the quantity they delivered, then a subsequent payment was made based on their total grain output. The CWB was responsible for grain transportation and marketing; it negotiated hopper car procurement with the two national railways and ensured delivery to grain handlers at the ports. After its dissolution, however, grain-handling firms sought to increase their efficiency and take advantage of reduced rates for deliveries using longer trains by centralizing their grain storage in large facilities capable of filling as many as 150 trains cars at a time.52

While the number of grain elevators in Western Canada fell from 917 in the 1999–2000 crop year to 413 in the 2021–2022 crop year, the overall storage capacity of these elevators rose from 7.4 million tonnes to 9.4 million tonnes over the same period.53 In theory, this shift to fewer but higher-throughput grain elevators makes transport more efficient and reduces the number of individual shipments needed to bring grain to port. In practice, larger trains often need to be divided due to rail capacity restraints at ports, which leads to delays. Some farmers also question the extent to which the savings from this practice affect the prices they receive for their grain upon delivery.

Rail industry stakeholders explain that the sector has found it increasingly difficult to recruit and retain employees, such that jobs remain vacant for a long time and current employees have to shoulder a larger workload. These stakeholders also express concerns about the age of railway workers where, according to a 2022 brief from the Railway Association of Canada, nearly 50% of them are between 45 and 64 years old, raising the prospect of more significant worker shortages over the next decade.54 For example, the demand over the next decade for railway carmen and carwomen is expected to outpace the number of jobseekers in this occupation by roughly 30%, and an estimated 57% of job openings will come as a result of retirements.55

In response, railway companies and industry associations have expanded their recruitment among groups that are underrepresented in the sector, in particular, women.

Women have always been underrepresented in the rail sector. For example, in 1984, the Canadian Human Rights Tribunal found that CN systemically discriminated against women in its hiring and promotion practices, and called for remedial programs to increase their representation.56 Despite these measures, in 2021, although women represented 48% of the Canadian workforce, they accounted for only 12.7% of employees in Canadian rail transportation.57 This is a lower rate than in truck transportation (14.6%) and transit and ground passenger transportation (23.7%), and in the broader transportation and warehousing sector (24.3%).58 This underrepresentation is even more evident in certain railway occupations: for example, less than 5% of train conductors (including freight and passenger rail) in Saskatchewan are women.59

While railway jobs pay relatively well, efforts to recruit workers from underrepresented groups may be hampered by a lack of a work-life balance for rail employees. Unions that represent rail employees have reported that their members frequently work long shifts, resulting in fatigue and concerns about worker safety.60 CN also cited a lack of housing in rural areas near railway depots as a recruitment obstacle.61

Labour-related disruptions, including work stoppages and strikes, have interrupted normal activity on Canada’s railways several times in recent years, including:

The Railway Association of Canada65 and CP have expressed concern over Bill C 58, An Act to amend the Canada Labour Code and the Canadian Industrial Relations Board Regulations, 2012 – legislation introduced by the federal government in the House of Commons on 9 November 2023 that would amend the Canada Labour Code66 to prohibit the use of replacement workers in federally regulated sectors, including private freight railway companies.67 In February 2024, this bill was referred to the House of Commons Standing Committee on Human Resources, Skills and Social Development and the Status of Persons with Disabilities for further consideration. At the time of publication, the Committee was still studying this bill.

Since 1996, section 87.7 of the Canada Labour Code has required striking longshoremen or other port workers to continue to service grain vessels in the event of industrial action. The minister of Labour at the time explained that the primary motive was to reduce the likelihood that Parliament would seek to intervene to end a strike through special legislation, citing the importance of the grain sector to Canada’s economy and trading relationships.68

While freight railways are touted as a greener alternative to truck transport,69 trains are predominantly powered by diesel combustion engines that produce and emit greenhouse gases. In 2021, the Canadian rail transport sector emitted 6.8 megatonnes of carbon dioxide equivalent (Mt CO2 eq), more than either the marine transport sector (4.4 Mt CO2 eq) or the aviation sector (5.6 MT CO2 eq).70 Notably, this figure does not take into account the emissions from diesel-powered equipment used in rail yards, such as maintenance vehicles and cranes; these vehicles produce and emit greenhouse gases and can also have a negative impact on air quality in surrounding areas.

The federal government’s 2030 Emissions Reduction Plan explains that for Canada to meet its climate objectives, all forms of transport will have to adopt cleaner energy sources. It calls on the rail sector specifically to continue building on voluntary commitments to completely decarbonize rail by 2050 by adopting zero-emission and electric locomotives.71

Decarbonizing Canada’s railways would, however, require significant investments in new infrastructure, including new rolling stock and refuelling equipment, that may be out of the reach of short-line railways which tend to retain less of their profits. A 2019 analysis by Transport Canada, cited by the Railway Association of Canada, estimated that electrifying Canada’s freight railways that have the heaviest volume of traffic would cost roughly $10.5 billion, but doing so would produce savings of more than $750 million annually in diesel fuel costs.72 Some technologies also have trade-offs in terms of efficiency: battery-powered electric vehicles, for example, can take upwards of an hour to fully charge, while hydrogen fuel cells can be recharged in as little as five minutes, but require refuelling infrastructure along the rail line, which involves a considerable initial investment.

Both CN and CP have announced plans to purchase zero-emission locomotives. In November 2021, CN announced that it would purchase battery-operated electric freight locomotives that it plans to operate on a 224-km section of its Bessemer and Lake Erie Railroad in the United States, after receiving a grant from the state of Pennsylvania.73 In the same month, CP announced plans to develop and operate three hydrogen-powered locomotives and hydrogen production and fuelling facilities in Calgary and Edmonton after receiving a grant from the Government of Alberta.74 One of the company’s hydrogen-powered locomotives made its first revenue generating trip in October 2022.75 In November 2023, CP announced the purchase of 12 additional fuel-cell engines to power locomotives slated to go into service in Alberta by late 2024.76

In addition to mitigating their emissions, railways have also sought to adapt their infrastructure to be more resilient in the face of extreme weather events, which are expected to increase in frequency and severity in coming years. In its 2022 report, the federal government’s Supply Chain Task Force identified climate change as a major source of instability in Canada’s transportation supply chain, including its rail networks.77 Recent extreme weather events have damaged rail infrastructure and disrupted the regular movement of goods, including grain transport; for example, the November 2021 floods and landslides in British Columbia’s Lower Mainland caused significant backlogs at the Port of Vancouver.78

Canada’s National Adaptation Strategy, a 2023 federal government document designed to provide a “whole-of-society approach” to reducing climate change risks, highlights the importance of building and maintaining resilient infrastructure, and establishes the objective to factor climate change impacts into infrastructure funding and planning decisions.79 Transport Canada’s Rail Climate Change Adaptation Program has funded approximately 800 projects that enable Canadian railways to take a proactive approach to climate change resilience by investing in better data collection and weather monitoring, as well as physically reinforcing infrastructure, in particular, raising railway tracks to allow rail service in flood-prone areas.80

Canada’s grain sector has evolved significantly in recent decades through legislative changes and infrastructure improvements. The International Grains Council expects that the global demand for grain will continue to rise in the coming years.81 As a grain-exporting country, Canada must ensure that Canadian companies and farmers have access to markets by equipping them with a reliable and efficient transportation and logistics system so that they can compete with the largest international companies.

The Canadian Transportation Agency is defined as

an independent, quasi-judicial tribunal and regulator that has, with respect to all matters necessary for the exercise of its jurisdiction, all the powers of a superior court. It oversees the very large and complex Canadian transportation system, which is essential to the economic and social well-being of Canadians.

See Canadian Transportation Agency, Acts and regulations.

[ Return to text ]In his 2019 book, Out of the Shadows: The New Merchants of Grain, Jonathan Kingsman estimates that Archer Daniels Midland, Bunge Limited, Cargill and Louis Dreyfus Company handle “just under 50 percent of the international trade in grain and oilseeds.” See Jonathan Kingsman, Out of the Shadows: The New Merchants of Grain, 2019.

A 2012 report by the non-governmental organization Oxfam estimates that these firms control “as much as 90 per cent of the global grain trade.” See Sophia Murphy, David Burch and Jennifer Clapp, Cereal Secrets: The world’s largest grain traders and global agriculture, Oxfam International, 3 August 2012.

[ Return to text ]© Library of Parliament