Any substantive changes in this Legislative Summary that have been made since the preceding issue are indicated in bold print.

Bill C‑26, An Act to amend the Canada Pension Plan, the Canada Pension Plan Investment Board Act and the Income Tax Act, was introduced in the House of Commons on 6 October 2016.1 It received Royal Assent on 15 December 2016.

The bill reforms the Canada Pension Plan (CPP) regime by making amendments primarily to the Canada Pension Plan and the Canada Pension Plan Investment Board Act. The objective of these amendments is to increase the amount of CPP benefits that working Canadians and their dependants will receive in the event of retirement, disability or death, subject to additional contributions being made. To offset the increase in CPP contributions, the Income Tax Act (ITA) is also amended to increase the Working Income Tax Benefit for eligible low‑income workers and to provide a deduction for employee contributions to the additional portion of the CPP.

These amendments are consistent with the agreement in principle reached by Canada’s finance ministers on 20 June 2016. Major changes to the federal CPP legislation require the consent of the Parliament of Canada and of at least seven of the 10 provinces representing two‑thirds of the population of all provinces.2

Canada’s retirement income system provides for a combination of public pensions and voluntary savings. The three main pillars of this system are:

The CPP regime provides contributors and their dependants with partial replacement of earnings in the event of retirement, disability or death. The CPP retirement benefit, for example, is fully available to the contributor at age 65, although it can be received as early as age 60 with a permanent reduction in the amount of the benefit, or as late as age 70 with a permanent increase in the amount of the benefit.

Not all contributors are eligible to receive the maximum CPP retirement benefit. In January 2018, the average CPP retirement benefit paid to new CPP beneficiaries aged 65 was approximately 60% of the maximum benefit, or $8,303 per year. The CPP retirement benefit currently replaces a maximum of 25% of earnings up to the Year’s Maximum Pensionable Earnings (YMPE). CPP recipients under age 70 who continue to work and to make contributions may also be eligible for a post‑retirement benefit, which would increase their retirement income.3

In addition to retirement benefits, the CPP provides a disability benefit to CPP contributors whose disability prevents them from working at any job on a regular basis, a survivor benefit to the surviving spouse and any children of a deceased CPP contributor, and a one‑time death benefit, which is usually paid to the deceased contributor’s estate.4

The CPP is financed through contributions by employees, employers and self‑employed persons, as well as through income earned on CPP investments. Currently, the CPP contribution rate is 9.9% of earnings between the basic exemption ($3,500 in 2018) and the YMPE ($55,900 in 2018). The maximum CPP contribution for employers and employees in 2018 is $2,594 each, while that for self‑employed individuals is $5,188.5

The CPP operates throughout Canada, except in the province of Quebec, where workers are covered under the Quebec Pension Plan.6

The Working Income Tax Benefit (WITB) is a refundable tax credit for eligible working low‑income individuals and families. It has two components: a basic amount; and a disability supplement that is available to individuals who qualify for the WITB and the disability tax credit.

The basic WITB is generally a refund of 25% of all working income exceeding $3,000, up to a maximum benefit level determined by the province or territory of residence and by family status. The WITB disability supplement is generally a refund of 25% of all working income exceeding $1,150, up to a maximum supplement level determined by the province or territory of residence and by family status. When they exceed certain thresholds, the basic WITB and the WITB disability supplement are reduced by 15% of each dollar of income earned by the beneficiary combined with the income of any spouse or common‑law partner.7

The 2016 federal budget announced the government’s intention to launch consultations to give Canadians the opportunity to share their views about enhancing the CPP. It indicated that “[a]n enhanced Canada Pension Plan would represent a major step in improving retirement outcomes for workers and reducing the uncertainty that many Canadians feel about being able to enjoy a secure and dignified retirement.”8

According to the Department of Finance Canada, the CPP enhancement is necessary because 24% of Canadian families approaching retirement age are at risk of not having adequate income in retirement to maintain their standard of living. In particular, the department has said that the projected after‑tax income at retirement for approximately 1.1 million families currently nearing retirement age will not replace 60% of their pre‑retirement after‑tax family income.9 A department study highlights younger workers as facing specific challenges that may make saving for retirement more difficult; these challenges include longer life expectancies, declining workplace pension plan coverage, a shift from defined benefit to defined contribution pension plans, and greater exposure to market risks, such as interest rate and asset price movements. The study also indicates that the CPP enhancement will respond to these needs by providing higher, predictable retirement benefits that are fully indexed to inflation.10

On 20 June 2016, the federal finance minister and his counterparts from all provinces except Manitoba and Quebec reached an agreement in principle to enhance the CPP. Since then, all nine CPP participating provinces have confirmed their support for the agreement in principle. On 22 February 2018, Quebec’s Bill 149, An Act to enhance the Québec Pension Plan and to amend various retirement‑related legislative provisions, came into force.11 This legislation made changes to the Quebec Pension Plan that are similar to those contained in Bill C‑26.

The CPP enhancement agreed upon by Canada’s finance ministers contains the following features:

The Department of Finance Canada has indicated that the CPP enhancement will be fully funded because the higher benefits that individuals will receive will be financed by increased contributions. It is also expected that, because it will take approximately 40 years of contributions for a worker to accumulate a full enhanced benefit (see Appendix B), younger Canadians entering the workforce will derive the greatest benefit from the CPP enhancement.13

The measures in the agreement in principle constitute the first major CPP overhaul in almost 20 years. In 1997, the federal and provincial governments agreed on a number of reforms, including an increase in total CPP annual contribution rates, a reduction in CPP administration and operating costs, and the creation of the Canada Pension Plan Investment Board (CPPIB).14

Most of the Bill C‑26 amendments to the Canada Pension Plan have one of the following three purposes:

Further, clause 1 amends a number of existing definitions and adds 18 definitions. Clauses 54 and 55 make consequential amendments to the Canada Pension Plan’s existing Schedule, while clause 56 adds Schedule 2.

Clauses 57 to 61 amend the Canada Pension Plan Investment Board Act (CPPIBA). Clauses 62 to 64 contain transitional provisions, while clause 65 provides for the coming into force of the amendments to the Canada Pension Plan and the CPPIBA. Finally, clauses 66 to 69 make related amendments to the ITA.

Clauses 3, 4 and 5 add provisions for the making of “first additional contributions,” beginning in 2019, by employees, employers and self‑employed persons, respectively, on earnings between the basic exemption and the YMPE. Clause 7 adds section 11.2, which states that first additional contributions are to be made at rates set out in new Schedule 2; these rates are shown below in Table 1. The result is a one‑percentage-point increase in the contribution rate – from 4.95% to 5.95% – by 2023 for both the employee and the employer, and a two‑percentage‑point increase – from 9.9% to 11.9% – for self‑employed persons.

Clauses 3, 4 and 5 also add provisions for the making of “second additional contributions,” beginning in 2024, by employees, employers and self‑employed persons on earnings between the YMPE and the new “Year’s Additional Maximum Pensionable Earnings” (YAMPE). Clause 12 adds section 18.1, which states that the YAMPE is 107% of the YMPE in 2024 and 114% of the YMPE in 2025 and subsequent years. Section 11.2 states that second additional contributions are to be made at rates set out in new Schedule 2; these rates are shown in Table 1 below.

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | ||

|---|---|---|---|---|---|---|---|---|

| Contribution rate on earnings between the basic exemption and the YMPE | For employees | 0.15 | 0.3 | 0.5 | 0.75 | 1.0 | 1.0 | 1.0 |

| For employers | 0.15 | 0.3 | 0.5 | 0.75 | 1.0 | 1.0 | 1.0 | |

| For self‑employed persons | 0.30 | 0.6 | 1.0 | 1.50 | 2.0 | 2.0 | 2.0 | |

| Contribution rate on earnings between the YMPE and the YAMPE | For employees | 0 | 0 | 0 | 0 | 0 | 4.0 | 4.0 |

| For employers | 0 | 0 | 0 | 0 | 0 | 4.0 | 4.0 | |

| For self‑employed persons | 0 | 0 | 0 | 0 | 0 | 8.0 | 8.0 | |

Notes:

Source: Table prepared by the authors using data obtained from Bill C‑26, An Act to amend the Canada Pension Plan, the Canada Pension Plan Investment Board Act and the Income Tax Act, Schedule 2.

Clauses 3(4), 9, 10 and 11 add provisions and make related consequential amendments to integrate the first and second additional contributions into existing provisions of the Canada Pension Plan relating to the following:

Clauses 2, 3(3), 13 to 18 and 19 replace the term “contribution” with “contributions” in a number of provisions as a result of the introduction of first and second additional contributions; as well, they make other consequential and clarifying amendments. Clause 19 also adds a reference to the new Additional Canada Pension Plan Account.

Clauses 3(1), 4(1), and 5(1) and 5(2) add the word “base” to a number of provisions to clarify that the amended provisions apply to previous CPP – or base CPP15 – contributions.

Lastly, clause 6 changes a reference to the existing Schedule as a result of the introduction of Schedule 2, specifying that the reference is to Schedule 1, and clauses 4(2), 4(3), 5(4) and 8 add references to certain new provisions.

Clauses 21 to 33 provide for the payment of additional CPP retirement benefits (clauses 21 to 30), and of increased CPP disability (clause 31), survivor (clause 32) and post‑retirement benefits (clause 33).

Clause 20 amends section 44, which – among other things – sets out eligibility criteria for CPP disability, survivor and post‑retirement benefits.

Clause 34 provides for the assignment of the additional CPP retirement benefits between spouses and common‑law partners.

Clauses 35 to 37 add the word “base” to a number of provisions to clarify that the amended provisions apply to the base CPP. Clauses 38 and 39 add references to the Additional Canada Pension Plan Account to ensure that the amended provisions apply to either the base CPP or the Additional Canada Pension Plan Account, as the case may be.

For those who apply for their retirement benefit at age 65, the CPP’s retirement benefit is 25% of average monthly pensionable earnings, which is the ratio of a contributor’s total pensionable earnings to the number of months in his or her contributory period. The amount of the retirement benefit paid to a contributor aged between 60 and 65 is reduced by 0.6% for each month during which the benefit is received before he or she reaches age 65. The amount of the retirement benefit paid to a contributor who defers his or her benefit after age 65 is increased by 0.7% for each month until he or she starts receiving the benefit or reaches age 70. The amount of the retirement benefit is adjusted annually for inflation. In 2018, the maximum monthly amount of the retirement benefit is $1,134.

Clause 21 amends section 46(1) to provide for the payment of additional CPP retirement benefits in relation to the first and second additional contributions; the additional benefits are calculated as 8.33% of “first additional monthly pensionable earnings” (FAMPE) and 33.33% of “second additional monthly pensionable earnings” (SAMPE). The amount of the base CPP retirement benefit continues to be 25% of average monthly pensionable earnings. Over time, the additional retirement benefits increase the income replacement rate from the current 25% to a total of 33.33% of total pensionable earnings, with the full increase available after 40 years (or 480 months) of additional contributions.

Clause 22 adds section 48.1, which – when the first additional contributory period exceeds 480 months – defines “FAMPE” as the total of the 480 highest monthly first additional pensionable earnings, divided by 480. When the first additional contributory period does not exceed 480 months, the FAMPE is the total of first additional pensionable earnings divided by 480. Clause 24 adds section 49.1, which defines the first additional contributory period as beginning on 1 January 2019 or when the contributor becomes age 18, whichever is later, and ending with the month preceding the month in which the contributor reaches age 70, or the month in which the contributor dies, or the month preceding the month in which the contributor’s retirement benefit begins to be paid, whichever is earliest.

Clause 22 also adds section 48.2, which – when the second additional contributory period exceeds 480 months – defines “SAMPE” as the total of the 480 highest monthly second additional pensionable earnings, divided by 480. When the second additional contributory period does not exceed 480 months, the SAMPE is the total of the second additional pensionable earnings, divided by 480. Clause 24 adds section 49.2, which defines the second additional contributory period as beginning on 1 January 2024 or when the contributor becomes age 18, whichever is later, and ending with the month preceding the month in which the contributor becomes age 70, or the month in which the contributor dies, or the month preceding the month in which the contributor’s retirement benefit begins to be paid, whichever is earliest.

Clause 26 amends section 51 so that the adjustment factor applied to first and second additional pensionable earnings for the purpose of calculating the FAMPE and the SAMPE is the same as that used for the base CPP, which is based on growth in average weekly wages and salaries. Clause 26 also adds section 51(1.1) to reduce first additional pensionable earnings for the 2019‑2022 period to account for lower rates of first additional contributions during that period.

Clauses 25, 27 and 29 add provisions to sections 50, 52 and 53 for the calculation of the following:

These amounts are used when calculating first and second additional pensionable earnings for a given month under section 51.

Sections 54 and 55.2 address the division of unadjusted pensionable earnings between spouses or common‑law partners when a relationship ends. Clauses 29 and 30 add provisions to these sections to provide for the division of first and second additional unadjusted pensionable earnings, and to make related consequential and clarifying amendments.

Clause 34 amends section 65.1, which provides for the assignment of a retirement benefit between spouses and common‑law partners, so that when an assignment is made the amount being assigned includes both the base CPP retirement benefit and the additional retirement benefits.

Clauses 21(2), 23, 26(4) and 26(5), 28, and other provisions contained in clauses 27 and 29 amend a number of sections to clarify that the amended sections apply to the base CPP.

The CPP’s disability benefit consists of two components: a flat‑rate benefit and 75% of the amount of the contributor’s CPP retirement benefit. In 2018, the maximum amount of the monthly disability benefit is $1,336.

Clause 31 amends section 56 so that the second component of the disability benefit is 75% of the sum of the base CPP retirement benefit and the additional retirement benefits described earlier. Section 56(6), which calculates the disability benefit in a situation where unadjusted pensionable earnings are divided, is amended to clarify that the division applies only in relation to the base CPP retirement benefit.

The eligibility requirements for the disability benefit are outlined in section 44(1)(b); one requirement is that a disabled contributor must have contributed for at least the minimum qualifying period. Clause 20 adds the word “base” before “contributions” so that the eligibility requirements for the increase in the CPP disability benefit are the same as those for the base CPP disability benefit.

The CPP’s monthly survivor benefit is paid to the surviving spouse or common‑law partner of a deceased contributor. It consists of the following:

The amount of the survivor benefit is reduced by 1/120 for each month that the survivor is less than age 45, unless he or she is disabled or has dependant children. If a survivor is receiving both a CPP survivor benefit and a CPP retirement benefit, the former is reduced such that the amount of the combined survivor and retirement benefits does not exceed the maximum amount of the CPP retirement enefit. If a survivor is receiving both a CPP survivor benefit and a CPP disability benefit, the latter is reduced such that the amount of the combined survivor and disability benefits does not exceed the maximum amount of the CPP disability benefit.

Clause 32 amends section 58 and adds a number of subsections to it so that the amount of the deceased contributor’s CPP retirement benefit that is used in calculating the CPP survivor benefit is the sum of the base CPP retirement benefit and the additional retirement benefits described earlier. The rules regarding reductions in a survivor or disability benefit when a survivor is receiving a survivor benefit in addition to either a retirement benefit or a disability benefit continue to apply in the same manner, with the exception of the limit on the amount of combined benefits that applied under the base CPP; this limit does not apply for the increase in the survivor benefit.16

Individuals aged from 60 to 70 years who are receiving a CPP retirement benefit and who continue to work and to contribute to the CPP are eligible for a CPP post‑retirement benefit.17 The amount of the post‑retirement benefit is a maximum of 1/40 of the maximum retirement benefit for each year that contributions have been made, adjusted for two factors: age, and the level of pensionable earnings on which contributions have been made. In 2018, the maximum monthly post‑retirement benefit is $28. A post‑retirement benefit begins to be paid in the year after the first year in which post‑retirement contributions have been made. Individuals who make such contributions for more than one year receive a corresponding number of cumulative post‑retirement benefits. For example, an individual who is receiving a CPP retirement benefit and makes CPP contributions from age 66 to age 70 will eventually receive a total of five post‑retirement benefits.

Clause 33 amends section 59.1 so that the amount of a CPP post‑retirement benefit is the sum of the base CPP post‑retirement benefit and two components that are based on the amounts of the first and second additional unadjusted pensionable earnings. The formula and adjustment factors used in calculating the two new components are the same as those for the base CPP post‑retirement benefit. The component that is based on the amount of first additional unadjusted pensionable earnings is reduced for the 2019‑2022 period to account for lower rates of first additional contributions during that period.

Clause 40 adds definitions for “additional Canada Pension Plan” and “base Canada Pension Plan.” The former means the part of the CPP relating to the new CPP benefits and all contributions required for those benefits. The latter means the benefits and contributions under the existing CPP regime.

Clause 46 adds section 108.2, which establishes the Additional Canada Pension Plan Account (ACPPA) and lists the types of amounts that are to be credited or charged to it in relation to the Additional Canada Pension Plan. For example, first and second additional contributions are credited to the ACPPA, and amounts payable for additional benefits are charged to it. The types of amounts credited or charged to the ACPPA are similar to those credited or charged to the existing CPP account concerning the base CPP. Clause 44 amends section 108 to clarify that amounts credited or charged to the existing CPP account are only regarding the base CPP.

Clause 46 also adds section 108.3, which provides that any amount in the ACPPA that exceeds immediate obligations is to be transferred to the CPPIB, and that the Minister of Employment and Social Development has the authority to require the CPPIB to pay amounts into the Consolidated Revenue Fund to offset charges to the ACPPA. These requirements reflect those that apply to the existing CPP account.

Clause 47 adds section 110(2) to provide for the charging of interest to the ACPPA for amounts paid out of the Consolidated Revenue Fund and charged to the ACPPA under section 108.2(3); interest is charged when the amounts paid out exceed the balance to the credit of the ACPPA. Section 110(2) reflects existing provisions that provide for the charging of interest to the existing CPP account under section 110(1). Clause 45 makes a consequential amendment because of section 110(2).

Clause 48 amends section 112, which requires the Minister of Employment and Social Development to prepare annual financial statements for the CPP. Now, those financial statements must include information on amounts credited or charged in relation to the Additional Canada Pension Plan.

Clause 50 amends section 113.1, which sets out the requirements for a triennial review of the CPP. Now, the review also occurs in relation to contribution rates and benefits for the Additional Canada Pension Plan. Clause 50 also adds sections 113.1(11.141) to 113.1(11.145) to set out the rules regarding adjustments to additional CPP contribution rates and benefits if either of the following values are not within a range set out in regulations to the Canada Pension Plan:18

Section 113.1(11.144) provides the Governor in Council with the authority to make regulations regarding the manner in which the contribution rates and benefits are changed in those situations, and the way in which the range is calculated. In accordance with section 113.1(11.145), these regulations may be made only with the consent of at least seven of the 10 provinces representing two‑thirds of the population of all provinces.

Clause 52 amends section 115, which requires the Chief Actuary of the Office of the Superintendent of Financial Institutions to prepare a report setting out the results of an actuarial examination of the CPP based on the state of the existing CPP account and the investments of the CPPIB; this report, which must be prepared every three years, informs the triennial review of the CPP. Now, the Additional Canada Pension Plan must also be considered in the actuarial examination.

Clause 53 amends section 118, which sets out the requirements regarding the making of employer contributions for federal employees. In particular, it adds similar requirements for additional CPP contributions.

Clauses 41 and 42 replace the term “contribution” with “contributions” in two provisions as a result of the introduction of the first and second additional contributions.

Clauses 43 and 49 add references to the ACPPA to ensure that the amended provisions apply to either the existing CPP account or the ACPPA, as the case may be. Clause 51 adds references to the first and second additional contribution rates and the ACPPA to section 114, which sets out the rules for amending the CPP. Clauses 45 and 47 make consequential amendments.

Clause 57 amends section 5(b) of the CPPIBA to authorize the CPPIB to manage any amounts transferred to it from the ACPPA. Clause 60 adds section 56(1.1) to provide for payments by the CPPIB to the Consolidated Revenue Fund as required by section 113(1.1) of the Canada Pension Plan, and to offset charges to the ACPPA. Clause 61 adds section 57.1 to allow the minister of finance to pay the CPPIB’s administration costs in relation to the Additional Canada Pension Plan out of the Consolidated Revenue Fund, with a corresponding charge to the ACPPA; such payments are to be made if the minister believes that the CPPIB cannot pay those costs. Section 57.1 reflects existing provisions contained in section 57, which allows such payments and charges to be made in relation to the base CPP.

Sections 39(4) to 39(6) of the CPPIBA provide for the preparation of annual and quarterly financial statements by the CPPIB. Clause 58 adds section 39(8) to require the CPPIB to prepare those financial statements jointly and separately regarding its management of amounts relating to the base CPP and the Additional Canada Pension Plan.

Clause 66 amends section 60(e) of the ITA to create a tax deduction for the first and second additional CPP contributions made by self‑employed taxpayers. Clause 66 also ensures that a self‑employed taxpayer will continue to be able to deduct one‑half of their base CPP contributions paid on self‑employed earnings.

Similarly, clause 66 adds section 60(e.1) to create a tax deduction for first and second additional CPP contributions made by employed taxpayers. Clause 68 amends section 118.7 to maintain the existing tax credit for base contributions to the CPP in respect of employment income other than self‑employed earnings.

Clause 67 amends section 117.1(1) to ensure that the basic WITB and the WITB disability supplement are indexed on the basis of annual increases to the Consumer Price Index.

Clause 69 amends sections 122.7(2) and 122.7(3), which set out the calculation for the basic WITB and the WITB disability supplement, respectively. The rate at which the refundable tax credit is applied increases from 25% to 26% for the basic WITB and the WITB disability supplement, and – for 2019 – the maximum basic WITB amount increases from $925 to $1,192 for single individuals and from $1,680 to $2,165 for families.

Additionally, clause 69 decreases the rate at which the basic WITB and the WITB disability supplement are reduced when net family income exceeds certain thresholds. For the basic WITB, the reduction rate decreases from 15% to 14%; for the WITB disability supplement, it falls from 15% to 14% if the individual has a spouse or common‑law partner who is not eligible to claim a disability tax credit, and from 7.5% to 7.0% if the individual has a spouse or common‑law partner who is eligible to claim that credit. The thresholds at which these benefits are reduced increases – for 2019 – from $16,667 to $20,844 for single individuals and from $25,700 to $32,491 for families.

| Upper Earnings Limit Phase‑In | Estimated Combined Employee/Employer Contribution Rate | ||||||

|---|---|---|---|---|---|---|---|

| Year | Projected YMPEa ($) | Projected Upper Earnings Limit ($) | Upper Earnings Limit as Share of YMPE (%) | Below YMPE (% of max) | Below (YMPE rate), % | Above YMPE (% of max) | Above (YMPE rate), % |

| 2018 | 58,000 | 58,000 | 100 | 0 | 0 | 0 | 0 |

| 2019 | 59,700 | 59,700 | 100 | 15 | 0.3 | 0 | 0 |

| 2020 | 61,500 | 61,500 | 100 | 30 | 0.6 | 0 | 0 |

| 2021 | 63,500 | 63,500 | 100 | 50 | 1.0 | 0 | 0 |

| 2022 | 65,600 | 65,600 | 100 | 75 | 1.5 | 0 | 0 |

| 2023 | 67,800 | 67,800 | 100 | 100 | 2.0 | 0 | 0 |

| 2024 | 70,100 | 74,900 | 107 | 100 | 2.0 | 100 | 8.0 |

| 2025 | 72,500 | 82,700 | 114 | 100 | 2.0 | 100 | 8.0 |

Note: a. YMPE: Year’s Maximum Pensionable Earnings. [ Return to text ]

Source: Adapted from Department of Finance Canada, Backgrounder: Canada Pension Plan (CPP) Enhancement.

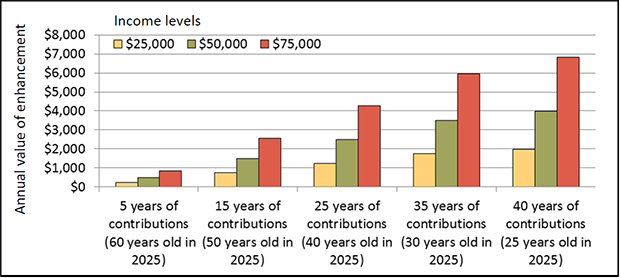

Figure B.1 – Annual Enhanced Canada Pension Plan Benefits for Different Age Cohorts and Income Levels

Note: Benefits are presented in wage‑adjusted 2016 dollars to provide a comparison with 2016 Canada Pension Plan (CPP) levels. This illustration assumes that individuals have constant earnings and take up CPP at age 65. The increase in benefits is based on contributions starting in 2025 (when enhancement is fully implemented). The amounts are rounded to the nearest $10.

Source: Adapted from Department of Finance Canada, Backgrounder: Canada Pension Plan (CPP) Enhancement.

* Notice: For clarity of exposition, the legislative proposals set out in the bill described in this Legislative Summary are stated as if they had already been adopted or were in force. It is important to note, however, that bills may be amended during their consideration by the House of Commons and Senate, and have no force or effect unless and until they are passed by both houses of Parliament, receive Royal Assent, and come into force. [ Return to text ]

© Library of Parliament