Airfares are a perennial topic in Canada, with complaints that Canadians tend to pay much more for a plane ticket than people in other countries.1 The various fees and taxes on air transportation in Canada are often cited as a key factor in explaining high airfares.2

Nevertheless, it is hoped that the arrival of ultra–low-cost carriers (ULCCs) – airlines that offer even lower base fares and fewer frills than regular low-cost carriers (LCCs) – will put downward pressure on overall airfares in Canada.

Bill C-49, An Act to amend the Canada Transportation Act and other Acts respecting transportation and to make related and consequential amendments to other Acts,3 which received Royal Assent in May 2018, eased foreign ownership restrictions for airlines in Canada in an effort to help ULCCs access a larger pool of investment capital.4

This Background Paper provides information on both airfares and ULCCs in Canada. The first section focuses on airfares and the various surcharges that are included in those fares. The second section provides more details on three airline business models: the models for full-service carriers, ULCCs and LCCs. The third section offers insights from academic literature on the potential impact of ULCCs on airfares in Canada.

Fees and charges in the Canadian air transportation system are often said to be among the reasons for the absence, until recently, of ULCCs in Canada.5 The following subsections examine some of these fees and charges.

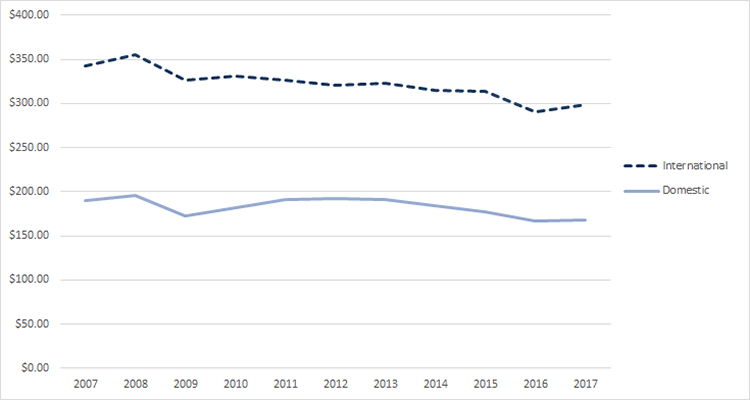

Figure 1 shows the average annual base airfare (i.e., before taxes and surcharges) for domestic and international flights in Canada from 2007 to 2017. During this period, the average base airfare declined from $189.43 to $167.93 for domestic flights (a 11% decrease) and from $342.15 to $299.05 for international flights (a 13% decrease). While average annual base airfares declined overall during this period, they did increase slightly in 2017 compared to the year before for both domestic and international flights.

Figure 1 – Average Annual Base Airfares, 2007–2017

(2018 dollars)

Note: The figure uses data for Air Canada and its affiliate airlines (i.e., Air Canada Rouge, Jazz and regional code-share partners), WestJet and Air Transat. All fare classes (business, economy, discounted and “other”) are also included. Statistics Canada collects the data from the air carriers as part of the mandatory Fare Basis Survey, which uses “[a] stratified random sample of 56 days per calendar year of flight coupons lifted by the participating Canadian air carriers.” For more information on the survey, see Statistics Canada, Fare Basis Survey (FBS)

Source: Figure prepared by the author using data obtained from Statistics Canada, “Table 23-10-0036-01: Domestic and international average air fares, by fare type group, quarterly.”

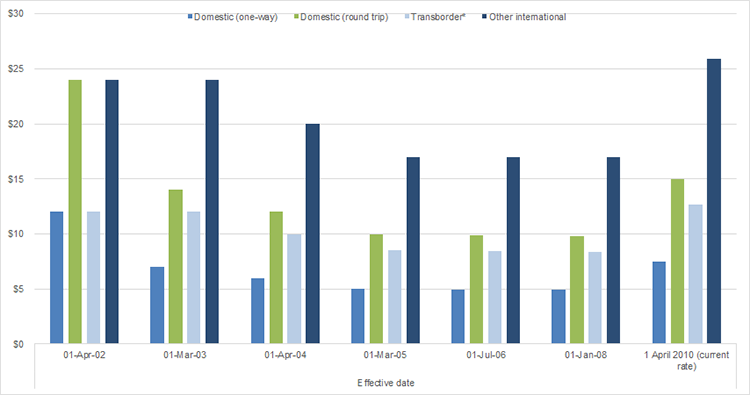

Since April 2002, the federal government has collected the Air Travellers Security Charge (ATSC) from airfares for flights that use Canadian airports where enhanced security measures are in place. The ATSC is meant to recover the costs of the air security program that was introduced in 2002 as a response to the 11 September 2001 terrorist attacks in the United States. Some of the ATSC, which goes into the federal government’s consolidated revenue fund, is directed towards the costs of the Canadian Air Transport Security Authority, which administers the security screening systems at airports.6

Figure 2 shows the amounts set for the ATSC since 2002. The current rates have been in place since 1 April 2010. Overall, the ATSC has decreased for domestic flights since it was first introduced in 2002 (though it is currently higher than its lowest point in 2008). In contrast, the ATSC has increased for both transborder and other international flights since it was first introduced.

Figure 2 – Air Travellers Security Charge, 2002 to present

(current dollars per enplaned passenger)

Note: * “Transborder” means travel to a destination outside Canada but within the continental zone (includes Mexico).

Source: Figure prepared by the author using data obtained from Transport Canada, Transportation in Canada 2016: Statistical Addendum, 2017, p. 67. (This document is available from Transport Canada upon request.)

Table 1 shows the airport improvement fees (AIFs) charged on airline tickets for flights originating at National Airports System airports. Part of the AIF is usually given back to the airlines to cover their administrative costs of processing the fee.

| Location of Airport | Airport Improvement Fee |

|---|---|

| Calgary | $30.00 |

| Charlottetown | $20.00 |

| Edmonton | $30.00 |

| Fredericton | $20.00 |

| Gander | $25.00 |

| Halifax | Travel outside Nova Scotia: $28.00 Travel from Halifax to Sydney, Nova Scotia: $15.00 |

| Iqaluit | $0.00 |

| Kelowna | $15.00 |

| London | $15.00 |

| Moncton | $25.00 |

| Montréal | $30.00 |

| Ottawa | $23.00 |

| Prince George | $25.00 |

| City of Québec | $35.00 |

| Regina | Travel outside Saskatchewan: $20.00 Travel within Saskatchewan: $5.00 |

| Saint John | $25.00 |

| Saskatoon | Travel outside Saskatchewan: $20.00 Travel within Saskatchewan: $5.00 |

| St. John’s | $35.00 |

| Thunder Bay | $0.00 |

| Toronto (Pearson International Airport) | Originating passengers: $20.00 Connecting passengers: $4.00 |

| Vancouver | Travel outside British Columbia and Yukon: $20.00 Travel within British Columbia and Yukon: $5.00 |

| Victoria | $15.00 |

| Whitehorse | $0.00 |

| Winnipeg | $25.00 |

| Yellowknife | $0.00 |

Source: Table prepared by the author using data obtained from Air Canada, What are the additional charges in my Fare?; and Regina Airport Authority, Public Notice: Aeronautical Rates and Fee Changes ![]() (72 kB, 5 pages) (changes in effect 1 June 2018).

(72 kB, 5 pages) (changes in effect 1 June 2018).

In addition to the government- and airport-mandated fees discussed above, airlines will typically charge a number of other fees. Airlines will often show these fees as a single surcharge when a ticket is purchased. In the case of Air Canada, for example, the airline may use its “carrier surcharges” to offset costs for “fuel, navigational charges, insurance charges, or select peak travel dates.”8

Although not explicitly reflected in airfares, airlines also pay various fees to airports – such as landing fees – in order to offer their services at those facilities. Airlines in Canada have often argued that these airport fees are one of the contributing factors to high airfares in Canada.9

Moreover, Canada’s largest airports, which are operated by private not-for-profit corporations as part of the National Airports System, pay rent to the federal government.10 These rents are sometimes cited as a contributing factor to the cost of airfare in Canada.11

Airfares are also subject to federal and provincial sales taxes.

In addition, federal and provincial governments charge excise taxes on aviation fuel. At the federal level, the tax is $0.04 per litre.12 The excise tax applies to flights that begin and end in the “taxation area,” which is defined as Canada, the United States (except Hawaii) and the French islands of St. Pierre and Miquelon, off the coast of Newfoundland and Labrador.13 Provincially, the aviation fuel excise tax rate varies from $0.03 to $0.11 per litre.14

People living with disabilities may face additional costs when travelling by air, if they need to travel with an attendant or require extra seating because of their disability. For example, if an attendant travels with the person, an extra airfare will be required, and while both Air Canada and WestJet offer free base fares (i.e., not including various surcharges and fees) for attendants on domestic flights, full fares must be paid on international flights.15 Similarly, both airlines offer extra seating free of charge to individuals who require it because of a disability, but only on domestic flights.16

The Council of Canadians with Disabilities has also noted that people with guide dogs may incur additional baggage charges, due to the extra weight of supplies (such as food and medicine) that they need to carry for their dogs.17

Full-service carriers – sometimes referred to as “network carriers” – “operate hub-and-spoke networks, deploying multiple aircraft types in short and long-haul routes, and offering a higher-class product overall.” 18 Such airlines may have different fare classes and, as part of the initial airfare, offer certain “frills,” like frequent-flyer programs and fee-free carry-on luggage, food, entertainment, and seat selection.

These airlines can offer “full service,” thanks, in part, to their complex hub-and-spoke networks, which allow them to carry travellers to and from most destinations while providing most of the services that travellers want.19

Canada has a history of emerging LCCs trying to compete with Air Canada and subsequently shutting down.20 Table 2 provides an overview of selected LCCs that have operated in Canada, with Air Transat, Sunwing Airlines and WestJet being the only ones that are still offering services. Air Transat and Sunwing Airlines both operate under a hybrid business model, in that they offer a mix of scheduled and charter flights. WestJet is now Canada’s second largest airline in terms of passenger numbers, and its business model has evolved into a hybrid of an LCC and a full service airline.21

| Airline | Founding Year | Year of Withdrawal from Market |

|---|---|---|

| Air Transat | 1986 | N/A |

| Canada 3000 | 1989 | 2001 (merged with CanJet and collapsed in November 2001) |

| Royal Airlines | 1991 | 2001 (was later acquired by Canada 3000) |

| CanJet | 1991, relaunched in 2002 |

2001 and 2015 (merged with Canada 3000 in 2001, relaunched in 2002, and withdrew again in 2015) |

| WestJet | 1996 | N/A |

| Jetsgo | 2001 | 2005 |

| Tango (Air Canada) | 2001 | 2003 (integrated into parent airline) |

| Zip (Air Canada) | 2002 | 2005 (integrated into parent airline) |

| HMY Harmony | 2002 | 2007 |

| Sunwing Airlines | 2005 | N/A |

Source: Table prepared by the author using data obtained from “Table 4.2: Developments in the Canadian low cost market (selection),” in Timothy M. Vowles and Michael Lück, “Low Cost Carriers in the USA and Canada,” The Low Cost Carrier Worldwide,ed. Sven Gross and Michael Lück, Ashgate Publishing Limited, Surrey, England, 2013. Information on CanJet obtained from IMP Group International Inc., History.

The difficulty of maintaining an LCC is not uniquely Canadian. A study of the European market, for example, found an LCC failure rate of 77% in the 20-year period between 1992 and 2012.22 Another European study notes that “One could draw up a similar list of defunct airlines in the United States and most other countries.” 23

Nor is it only the LCC business model that is challenging. Historically, profit margins for all airlines have been quite narrow, and the LCC business model is seen by some as an effort to increase those narrow margins.24

A ULCC can be defined as an airline that charges a low base fare – often lower than LCCs – for a ticket that provides only the passenger’s seat on the plane, while charging à la carte for every other part of the flight experience. Other characteristics of the ULCC business model may include lower labour costs,25 the standardization of plane size and seating options, point-to-point (rather than hub-and-spoke) flight patterns, the use of lower-cost airports and a general focus on cost control. Of course, LCCs share many, if not most, of these characteristics, to the extent that the academic literature does not always distinguish between the two business models.26

Some ULCCs, such as Flair (formerly, Newleaf), Wow Air and WestJet’s Swoop Airlines, have entered the Canadian market in recent years.27 The Conference Board of Canada also considers Air Canada’s Rouge brand and Enerjet (a charter airline) to be ULCCs.28 Others, such as Jetlines and Norwegian Air, are expected to enter the Canadian market later in 2018 and in 2019.29

Increasingly, airlines are adopting hybrid business models, with some full-service carriers offering unbundled fares and some LCCs offering different classes of airfare or including certain “frills” in their base fares.30 Some affiliate airlines, working with a low-cost model, also operate under the banner of a full-service airline (e.g., Air Canada Jazz). As a result, the “ultra” label is perhaps a matter of extent, with ULCCs taking these characteristics even further than a typical LCC (for example, by offering even lower fares and fewer frills than LCCs).

There has been little research to date on the overall impact of ULCCs on the market in Canada, perhaps because of their nascent nature in this country. A winter 2018 market outlook from the Conference Board of Canada states that ULCCs are expected to put downward pressure on airfares. The report also notes that incumbent airlines have already begun lowering prices in an effort to deter potential new entrants.31

The academic literature on LCCs and ULCCs 32 from the United States and other countries may offer further hints about the potential impact that these airlines may have in Canada.

It is possible, however, that the Canadian experience will prove to be different from that of other countries. Due to the various fees and surcharges discussed above, as well as differences in geography, population density, regulatory environment and airport governance, Canadian ULCCs may need to chart a new course to a profitable and sustainable business model.33

The study also compared average fares in markets where ULCCs and LCCs were present with fares in markets where neither type of airline operated. Where only a ULCC was present, average market fares were 20.5% lower.35 In markets with both LCCs and ULCCs, average market fares were 19.8% lower.36

The researchers also found that ULCCs abandon 26% of new markets within two years of entry, a market attrition rate that is three times higher than LCCs.37

The academic literature has given a name to the impact of LCCs on rival airlines: the “Southwest Effect,” after Southwest Airlines, an LCC that offered its first flights in June 1971.38 Researchers have identified a twofold effect when Southwest Airlines enters a new market: (1) a significant increase in the overall number of passengers travelling in that market; and (2) a noticeable decrease in the average airfares that passengers pay in that market.39

One such study found that incumbent airlines react pre-emptively to the threat of Southwest Airlines’ entry into a particular route.40 Specifically, incumbent airlines typically lower their airfares before Southwest Airlines enters the market.41

Studies suggest that other American LCCs have this effect on their respective markets to varying degrees; indeed, the Southwest Effect could be described more broadly as an LCC effect.42

Academics have also published studies on the impact of LCCs in other countries.43 The literature on European LCCs, for example, suggests that competition from airlines such as Ryanair and easyJet resulted in full-service airlines reducing their business and leisure-class fares.44

The impact of LCCs in India and China has also been examined. One study found that in India, the prevalence of LCCs has lowered airfares and increased consumer demand for air travel. The study’s findings for China were less clear,45 but did nevertheless discover some evidence of lower airfares and increased consumer demand (though to a lesser extent than in India).46

Another study of the Chinese situation focused specifically on the response of China Eastern, a full-service carrier, to the entry of an LCC, Spring Airlines, at its hub airports in Shanghai. The study found that while the LCC did indeed put downward pressure on the average airfares of the full-service carrier, the modest price reduction of between 4.0% and 4.9% suggests that China Eastern did not consider Spring Airlines to be a major competitor.47

A study of LCCs in São Paulo, Brazil, examined how incumbent airlines react to the threat of an LCC’s entry, finding that incumbent airlines pre-emptively increased their flight frequencies and lowered prices on threatened routes.48

Average annual base airfares have declined since 2007, but those base fares are only part of the cost of flying; Canadians also pay a number of other fees and taxes on top of those base airfares.

It is hoped that ULCCs will reduce overall airfares in Canada, and the academic literature on ULCCs and LCCs suggests that such an effect is indeed possible. Moreover, there is some evidence that Canadian ULCCs already may have put downward pressure on airfares.

Nevertheless, key differences in the Canadian market may prevent an exact replication of other countries’ experiences. For example, some stakeholders suggest that the various fees and taxes paid on Canadian airfares are among the reasons for the slow entry of ULCCs into the Canadian market.

Moreover, the notoriously low profit margins of airlines – not to mention the history of LCC closures in Canada and abroad – suggests that the success of new airlines, including ULCCs, is not always guaranteed.

† Library of Parliament Background Papers provide in-depth studies of policy issues. They feature historical background, current information and references, and many anticipate the emergence of the issues they examine. They are prepared by the Parliamentary Information and Research Service, which carries out research for and provides information and analysis to parliamentarians and Senate and House of Commons committees and parliamentary associations in an objective, impartial manner. [ Return to text ]

© Library of Parliament